When improved 19th century optics technology enabled astronomers to observe the trajectory of Mercury around the sun, they discovered it didn’t follow the path anticipated by Newton’s laws. But instead of disputing Newton’s theory, many astronomers decided that invisible dust was the cause of Mercury’s deviation from its expected trajectory.

Many investors appear to be making the same mistake as these astronomers by using equilibrium theory to ground asset allocation decisions. During the 2008 crash, U.S. pension fund losses wiped out the gains from the prior two years. Curiously the response to this has been to reduce asset allocation for equities to 50%, down from 60% in 2007. Hence when the next crash comes, pension funds will still have heavy losses, only marginally less so.

Getting it right

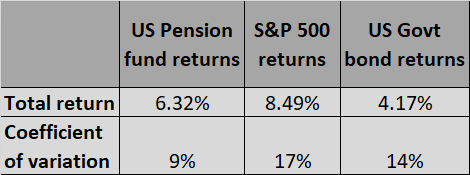

Getting asset allocation right is critical if pension funds are to generate sufficient returns to meet their liabilities. Over the last 10 years, US pension fund returns have averaged 6.32% which is below the expected rate of return of 7.52% over the period. As table 1 shows, these returns are lower than equities but greater than bonds, although the volatility of returns is lower than both asset classes.

Table 1: Returns & volatility of US pension funds, equities & bonds 2008 – 2017

Source: Thomson Reuters Datastream, Milliman, Credit Capital Advisory

The typical approach to asset allocation is grounded in the idea that an economy operates around its equilibrium level through time as described in the capital asset pricing model (CAPM). By grounding asset allocation in an equilibrium approach, it follows that the expected rate of return can be explained by how the market has performed historically. Differences in future returns are therefore mere deviations from equilibrium. This suggests that having a mix of equities and bonds over the business cycle would generate an optimum portfolio allocation.

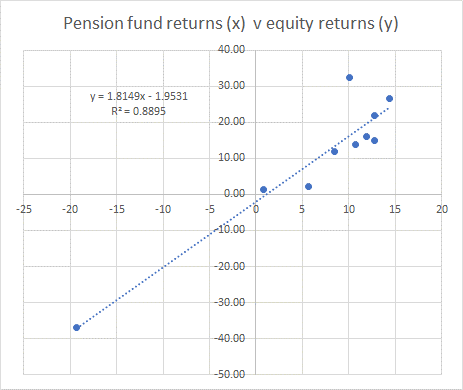

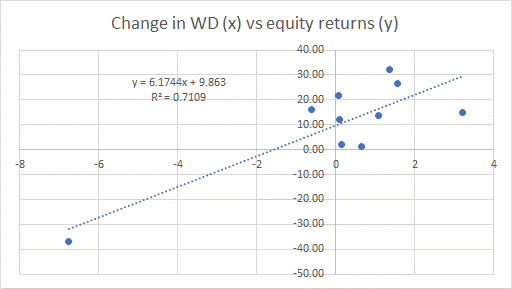

However, such an approach to asset allocation is flawed on two counts. First, an analysis of returns data indicates that equity performance is by far the most important driver of pension fund returns. Second, equity returns are affected by the credit cycle which can be measured by the change in the Wicksellian Differential. The Wicksellian Differential is the return on capital minus the cost of capital. If the difference is rising, it implies that the rate of profit growth is increasing, which generally has a positive effect on equity returns. If the Wicksellian Differential is falling, then the rate of profit growth is in decline, which generally has a negative effect on equity returns.

Chart 1: Pension fund returns and change in WD vs equity returns 2008 – 2017

Source: Thomson Reuters Datastream, Milliman, Credit Capital Advisory

Source: Thomson Reuters Datastream, Milliman, Credit Capital Advisory

Investors grounded in an equilibrium framework will periodically be impacted by large deviations from equilibrium resulting in catastrophic losses. This is likely to lead to a further reduction in allocation to equities, which in turn will exacerbate pension fund deficits as returns will be lower.

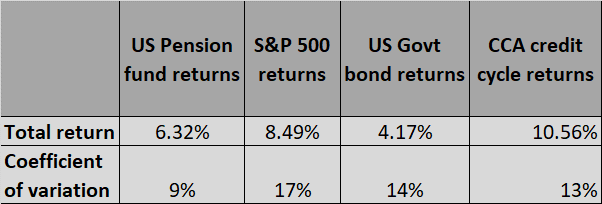

Investors should instead ignore equilibrium frameworks and invest across the credit cycle using dynamic asset allocation. If pension funds had followed the credit cycle, using a set of quarterly ex ante signals, they would have seen a dramatic improvement in returns without a significant increase in volatility. This excess return is derived from being in equities in the upswing of the cycle and in bonds in the downswing, thereby avoiding the effects of capital destruction on portfolios.

Table 2: Returns & volatility of US pension funds vs credit cycle approach 2008 – 2017

Source: Thomson Reuters Datastream, Milliman, Credit Capital Advisory

Stay in while it’s hot

The central challenge for credit cycle investors is to monitor the turning point of the cycle. This enables investors to maintain exposure to equities during the upswing, only to join the “low return bears” once the rate of profit growth has started to slow.

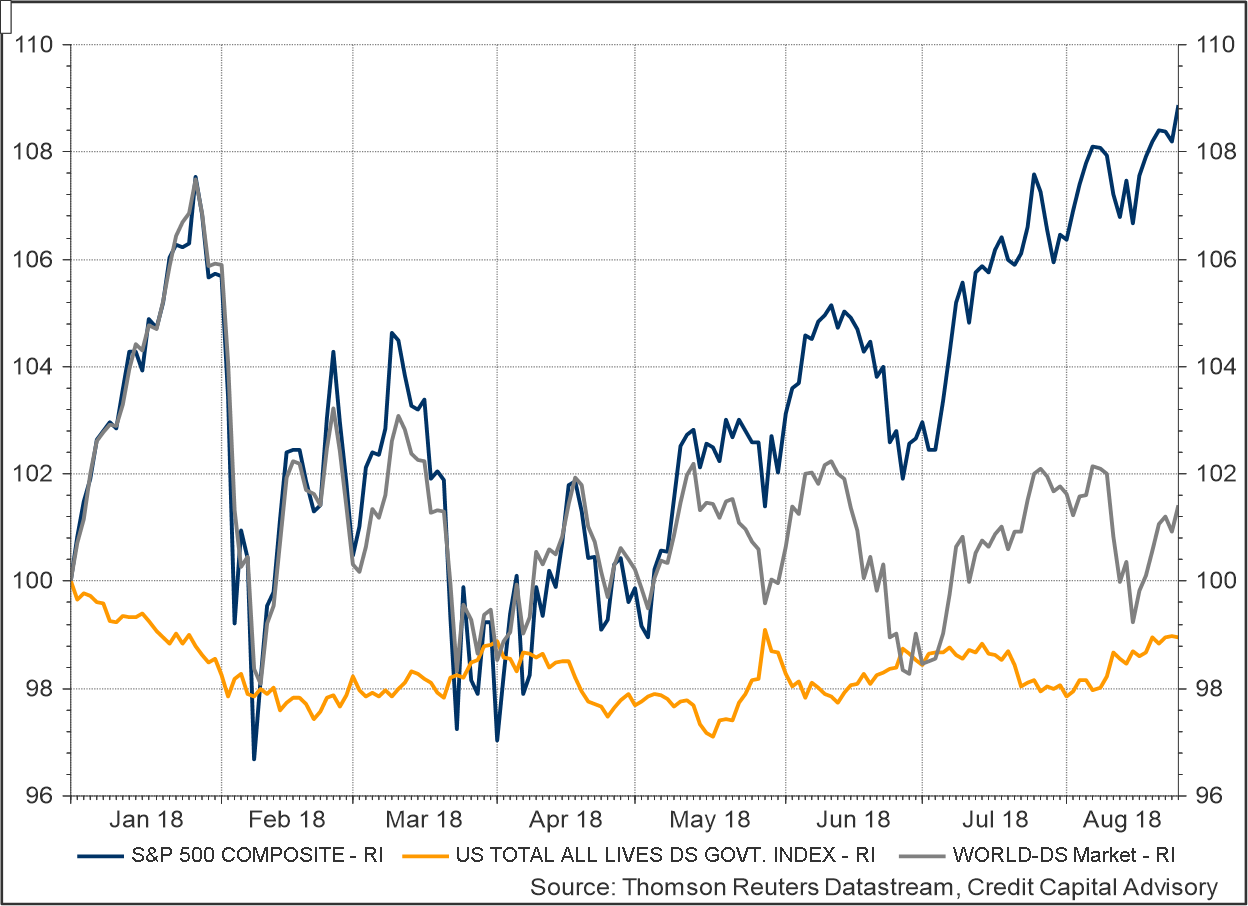

The Credit Capital Advisory signal has been positive on US equities since August 2016, and despite the continual negative news flow has significantly outperformed global stock markets and US government bonds since the start of the year. The main driver for this outperformance is the ongoing rise in profit growth and hence a positive Wicksellian Differential.

Chart 2: US equities, global equities & US government bonds

Looking ahead

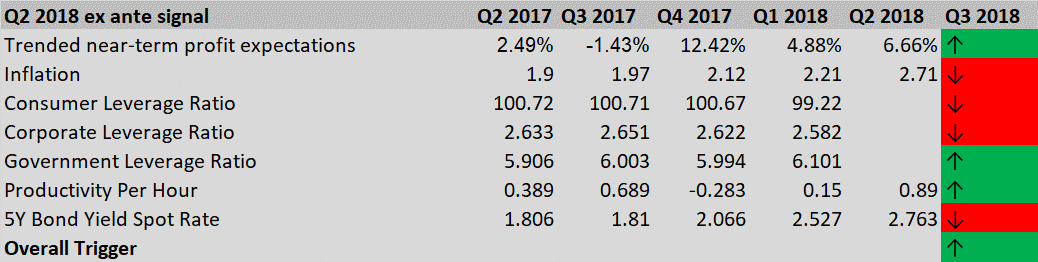

While short term profit growth is expected to increase in all sectors except for industrials, along with positive productivity figures, the declining corporate and consumer leverage ratios still indicates that the business cycle is in its final phase as shown in table 3.

Table 3: US Equity market ex ante dashboard

Source: Thomson Reuters Datastream, Credit Capital Advisory

Although inflation, which has been affected by both rising commodities and tariffs, continues to rise, bond yields have not yet adjusted upwards to take account of less-open markets. Either the bond market is asleep at the wheel or it believes that the current trade impasse is a mere blip towards freer trade. This would require China to shift away from its protectionist stance resulting in Trump removing the newly imposed tariffs. However, if the bond market has misjudged this, then the cost of funding will rise further, causing the Wicksellian Differential to fall, indicating a downward shift in the cycle.

Out with the old, in with the new

When Einstein published his theory of relativity, astronomers finally gave up the hopeless task of trying to fit the facts to an outdated theory. A reduction in equity exposure from 60% to 50% will not have much material impact on losses when the market moves into its down phase. Sadly for US savers, it may require another catastrophic fall in asset values for pension funds to finally ditch an equilibrium foundation and shift towards dynamic asset allocation across the credit cycle.