With a third of the year already gone, it seemed timely to look at how the credit disequilibrium model has performed to date. The US model continued to signal equities and year to date they have performed better than bonds generating nominal returns of 2.4% versus 1.5% from bonds.

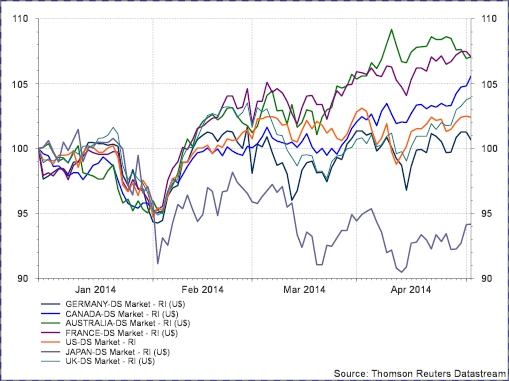

Within equities, the model highlighted France as having the strongest signals followed by the US and UK with Canada a weaker positive signal. Japan was neutral and Australia and Germany were negative. Overall the model has performed well. France has had a strong performance and is up 7.5% to date with Canada, UK and US all up between 2 and 5%. Germany has performed less well as expected and Japan has had a bad start to the year.

The one exception to the model was Australia which in January was generating a negative signal. Although the near term natural rate of interest indicators were positive, all three leverage ratios were negative. The leverage ratios used for Australia are less timely than other markets which when updated in early March showed a sharp reversal largely explaining Australia’s robust equity performance.

Chart 1: YTD nominal equity total returns

Based on the most recent data sets, Australia and France now have the strongest signals with the US also positive although financial services has joined construction indicating negative near term natural rate of interest outlooks. The UK’s signal has become much weaker with robust near term natural rate of interest indicators reduced by falling consumer and corporate leverage ratios. Japan is displaying similar characteristics with its strong near term natural rate of interest indicators negated by a decline in all three of its leverage ratios implying that the robust near term positive outlook is not expected to be part of a longer term trend. Germany is generating a weak negative signal with mostly falling near term natural rate of interest indicators and a declining consumer leverage ratio although financial services remains a bright spot. Canada after its record leverage boom has finally turned negative. Its near term natural rate of interest indicators are mostly negative with falling consumer and corporate leverage ratios. As Minksy and Hayek argued all good credit bubbles must eventually come to an end. As a result we can now expect to see rising systemic risk across the Canadian financial system.