When Ronald Reagan said that the nine most dangerous words in the English language were “I’m from the government and I’m here to help,” he provoked a storm of protest from all sides of the political debate. Governments clearly can help drive competitiveness through improved skills policies, by investing in infrastructure and housing, as well as supporting innovation through R&D and incentivizing capital investment towards startups.

Indeed Reagan embarked upon a radical new industrial strategy – the Small Business Innovation Research program – which between 1995 and 2018 generated an additional $184 billion in value added.

But governments and investors should realize there is a point to Reagan’s quip. Countries that have embarked upon, for example, nationalization strategies have not generally not produced sustainable, profitable companies. China’s stock market continues to flounder as noted in chart 1, while North Korea and Cuba remain poor countries. Furthermore, prior attempts at industrial policy in the 1960s and 1970s did not work particularly well when European countries attempted to pick winners such as the development of supersonic aircraft.

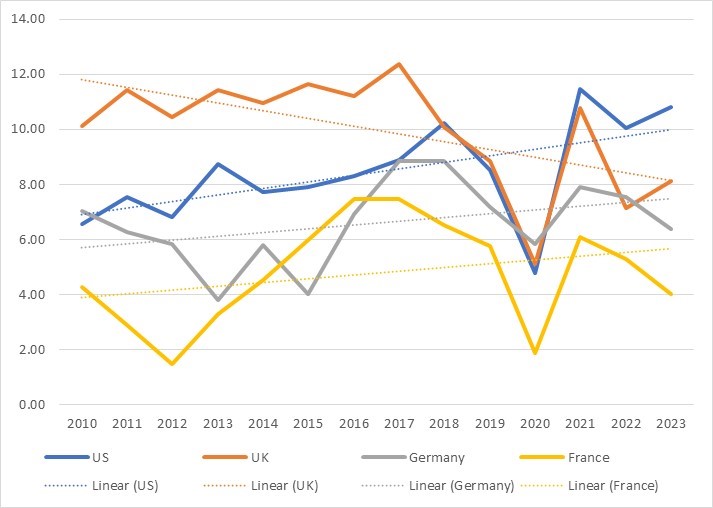

Chart 1: International Stock Market Performance 2010-2023

Reagan’s quip relates to the fact that governments do not have sufficient knowledge to necessarily improve outcomes. This point was noted by Hayek in his seminal 1945 article on the use of knowledge in society. Hence incremental changes are more likely to be a better approach to support firms, where the outcomes of policies can be assessed and amended if necessary – rather than large-scale, wholesale change.

When Britain voted to leave the European Union, there was no necessary requirement to make significant changes to the existing economic arrangements of firms. Indeed, for nearly 30 years UK firms had been incentivized to develop commercial relationships across European markets as the Thatcher administration had significantly reduced red tape for UK firms to operate there. Following the opening up of the single market, the UK economy grew at a faster rate – and began to catch up with other countries in terms of productivity growth.

However, the Johnson administration in 2019 decided to fundamentally alter the economic arrangements of UK firms based on its nationalist doctrine. These policies are probably the most significant intervention forced on the daily workings of UK companies since the wave of nationalizations in the late 1940s. Firms that had developed commercial relationships across Europe found that the increased red tape and regulation implemented by the Johnson administration significantly reduced their competitiveness when the UK left the EU.

This can be seen clearly when we look at the trend in the Wicksellian Differentials between the US, UK, France and Germany since 2010. This is computed by subtracting the aggregate cost of capital from the aggregate return on capital, which provides a clear signal of competitiveness related to rising or falling profits. This measure, which was set out in my 2012 book Profiting from Monetary Policy, is used by investors to invest across the credit cycle to generate equity like returns with reduced volatility. When the trend of the Wicksellian Differential is rising it indicates a positive outlook for capital values, and when it’s falling it indicates a negative outlook.

Between 2010 – 2023 the UK is the only country that has experienced a declining trend in its Wicksellian Differential indicating weakening competitiveness and a falling rate of profitability. Conversely, the US has seen a sharp increase in competitiveness – in addition to now generating the highest returns on capital. Given that equity valuations are linked to future profitability, the anticipated outperformance of the US stock market has been very clear in the data as noted in prior quarterly notes – as has been the ongoing underperformance of the UK market.

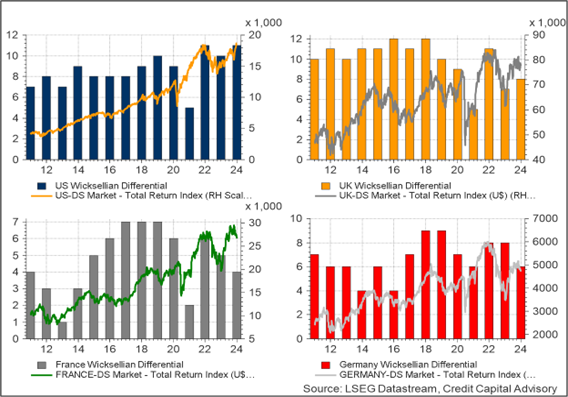

Chart 2: Wicksellian Differential comparisons

Source: LSEG Datastream, Credit Capital Advisory

Although France and Germany have experienced an upward linear trend, current levels of the Wicksellian Differential are below those of 2018 and 2019 as noted in Chart 3. The 2023 data also demonstrates a divergence with a rising trend for the US but a falling trend for France and Germany. This is why these markets have not experienced similar returns to the US which has been able to demonstrate continuous incremental improvements.

Chart 3: Relationship between Ex post Wicksellian Differential and stock market performance

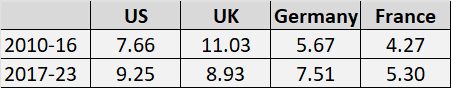

One striking aspect of the UK data is just how poorly it has performed in the latter period. Although all four economies were clearly impacted by Covid-19 as highlighted in Chart 3, the UK experienced a two percentage point fall when comparing the averages over the two periods as per Table 1. This fall in the UK was driven by a decrease in the return on equity for UK financial services firms who had built up a competitive advantage across the EU. In addition, the return on capital for firms involved in transportation, trade and retail – alongside business services — fell. Construction firms together with energy and basic resources firms were less impacted. The data clearly indicates Reagan was on to something, and that government interference in the economy can negatively affect business performance.

Table 1: Average Wicksellian Differential 2010-2016 and 2017-2023

Source: LSEG Datastream, Credit Capital Advisory

Despite this government interference driving down the competitiveness of UK firms, there does appear to be finally some good news for the UK. After grappling with this unprecedented level of government interference, managers are beginning to figure how to operate within the new trading arrangements that the government has forced on them. Near-term trended profit expectations are up in the business services and trade & transportation sectors, and the corporate leverage ratio has ticked up indicating firms see a positive outlook and are willing to increase investment.

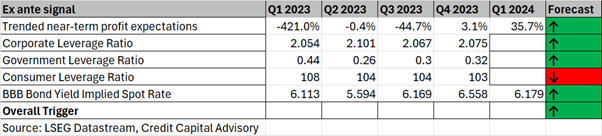

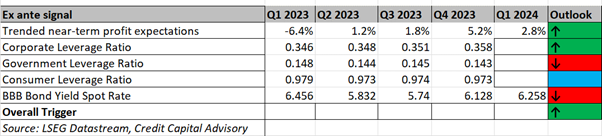

Table 2: UK Summary ex ante signal

Hence after years of being rejected by asset allocators due to a poor outlook, UK assets may start to offer an alternative to fund managers who have instead preferred to allocate capital to US equity assets. The outlook for the US continues to remain positive with trended near term profit expectations rising – particularly across the large services firms that have been such a critical factor in driving US equity markets higher.

Table 3: US Summary ex ante signal

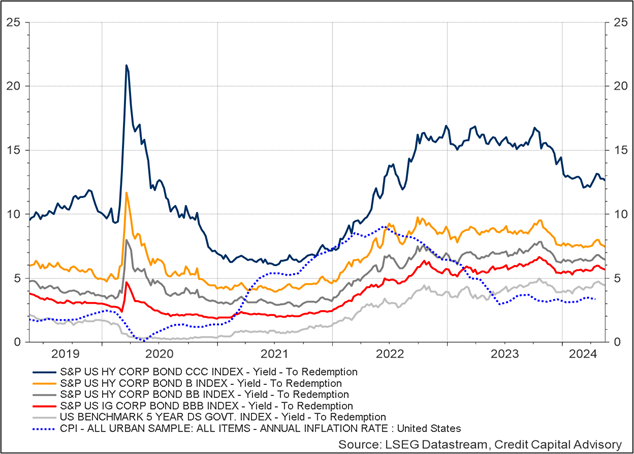

While this positive outlook for US equities continues to be supported by the bond market with stable credit spreads as per Chart 4, it is unclear to what extent bond investors have sufficiently identified assets impacted by the ongoing slow credit deterioration; such as B bonds.

Chart 4: US bond market indicators

Ronald Reagan was a proponent of a certain kind of government support; focused on driving new products and services to improve competitiveness. British governments since the 2016 referendum have instead focused on transformational change, forcing firms to upend their commercial arrangements through increased regulation and red tape. This massive government interference in the functioning of firms caused a negative profitability shock which is why the UK stock market has underperformed, and why the UK has been treated as a pariah by so many investors. Now the Wicksellian Differential is shifting towards a positive outlook, investors can start to think about reallocating assets back in to the UK.