The bond market remains confused about interest rates, which is why it continues to generate such unusual levels of volatility. One possible explanation for this ongoing uncertainty is that there is a fundamental difference of opinion between bond traders who have only experienced abnormal bond market conditions since 2008, and those who are, let’s say, long in the tooth.

During the first half of 2023, the US 10 year nominal bond yield averaged just 3.63%, with the 30 year benchmark at 3.78%. The market appeared to be indicating that inflation would quickly fall back to 2% and that nominal demand would remain somewhat subdued. Neither of these assumptions, however, was supported by the data. The bond market somewhat belatedly realised its error and during October, the 10 year yield averaged 4.78% with the 30 year yield at 4.93%. In the last few weeks, however, bond yields have fallen again. The 10 year yield is now at 4.50% and the 30 year at 4.63%. The bond market, it appears, is now making its second mistake this year.

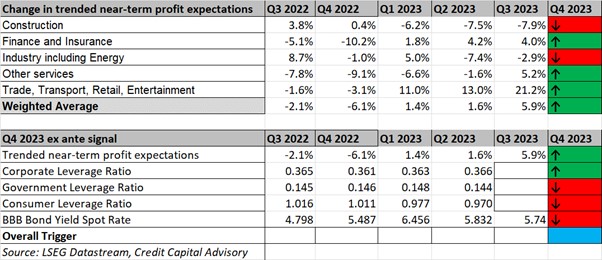

The US economy remains in pretty good shape. Near-term trended profit expectations are up in key sectors of the economy with regards to Q4 earnings to be announced in early 2024. Moreover, this outlook remains positive despite the higher level of interest rates. The reality is that firms do not invest because interest rates are low, but when future profit expectations are rising which tends to be in a rising interest rate environment. Indeed, when the central bank maintains low interest rates, it is communicating to the market that the outlook for future economic activity is poor, thereby dampening activity.

Table 1: Outlook for US Wicksellian Differential

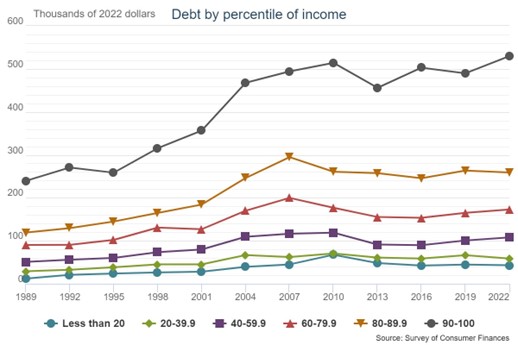

US firms’ investment leverage ratio has risen marginally indicating reasonable confidence about the future. Conversely, consumers continue to deleverage due to rising interest rates, indicating potential lower future consumption. The higher levels of income to debt indicate consumers are in a better shape to weather the jump in the cost of borrowing. Furthermore, the vast majority of consumer debt is concentrated in wealthier percentiles who have a lower marginal propensity to consume. Hence as interest payments take up more of wealthier household income, it is on balance more likely to impact their propensity to save rather than their propensity to consume.

Chart 1: US Average household debt by percentile of income

In addition, employment continues to be extremely robust with job openings still over 9.6 million, and a job openings rate of 5.7%. This places labour in a comparatively strong bargaining position, indicating consumers are more likely to be able to continue to service their debts. Crucially for central banks, this is likely to make it much harder for inflation to fall below 3% – suggesting it may take more time before the Fed starts to reduce short term rates to a medium term “steady state” level of around 4%.

The improved outlook for profit growth indicates it is feasible that the return on capital – which is double that of European countries – may well increase in 2023 up from 12.8% in 2022, particularly if recent productivity figures continue to be robust. However, it remains uncertain whether this growth will outweigh the increase in the cost of funding to drive up the Wicksellian Differential.

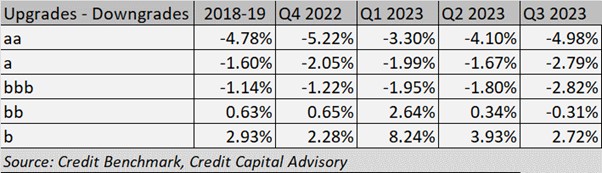

Despite this overall positive outlook, the significant increase in the cost of funding is impacting those firms whose investments are more marginal – although many of these firms folded as a result of the pandemic. The data, for North American Corporates based on over 40,000 observations from Credit Benchmark, shows that there is a deterioration in credit quality across all investment grade rating bands compared to 2018-19 conditions – alongside bb firms. However, there are still more upgrades than downgrades for single b obligors – suggesting that a substantial increase in defaults is unlikely in the short term.

Table 2: Credit Transition Matrix – North America Corporates

In addition, credit spreads above the 5 year benchmark continue to demonstrate stability as per chart 2 for B rated bonds and above – although C rated bonds continue to indicate stress. The jump in the cost of funding is likely to start impacting single B bonds at some stage, and hence single B spreads may slowly begin to widen.

Chart 2: US Bond market indicators

The data highlighted above suggests the US economy will continue to demonstrate reasonable nominal GDP growth with a decent outlook for companies. Consumers should be able to keep spending, albeit at potentially lower rates, while being supported by a robust labour market. This will make it much harder for inflation to fall quickly from 3% to 2%, and hence there is likely to be a delay before short term rates start to fall. Long term bond yields are therefore, likely to start to rise once the bond market has realized it has misjudged the US economy once again.

Credit Capital Advisory has forecast where the yield curve might end up in a future “steady state” non-inflationary model. It indicates that the 5 year yield is not too far off where it should be, however, the 10 year and 30 year will need to rise to reflect the term premium or the risk of holding debt with longer term maturities.

Chart 3 shows a very strong negative correlation (-0.8) between a change in the central bank interest rate and an inverse change in the term premium which is defined as the spread between the 30 year and 5 year rate. The 5 year rate is used as the reference as current 5 year yields are close to the CCA forecast. That means that when the Fed finally decides to start nudging short term rates down, the term premium is highly likely to rise. In essence, investors at the long end of the curve will not only need to contend with higher than expected NGDP and inflation, but also the shift in the term premium as the Fed starts reducing interest rates.

Chart 3: Relationship between Fed funds rate and term premium

So where does this leave asset allocation for fund managers? Investors who believe long term bond yields are likely to fall to post 2008 levels might want to reassess this view given the bond market since 2008 has been operating under normal abnormal conditions. The short end of the curve, however, will generate a reasonable yield and potential capital gain once the Fed starts reducing rates, but the long end could be hit with capital losses.

With regards to equities, the outlook is on the one hand reasonable with raised expectation of profit growth in certain sectors, however, this is clouded as to whether any increase in the return on capital from 2022 might outweigh the rise in the cost of funding. This is difficult to predict with any certainty. That said, there is a case for balancing the portfolio 50:50 between large cap US equities in certain sectors – which are currently the main drivers of profit growth – and the shorter end of the yield curve.

Although credit cycle investing has tended to be rather dismissive of the concept of a permanent balanced portfolio, at this juncture in the credit cycle, it would appear to be a potential way to generate reasonable returns with reduced volatility.