Last month, U.S. Secretary of State Mike Pompeo spoke of the need for a new grouping of democracies to face what he argued was the increasing threat to freedom from China. While Pompeo didn’t give much away on how this might be approached, he did recognise that it raised a set of complex new challenges, given the interconnectivity between China and the U.S.

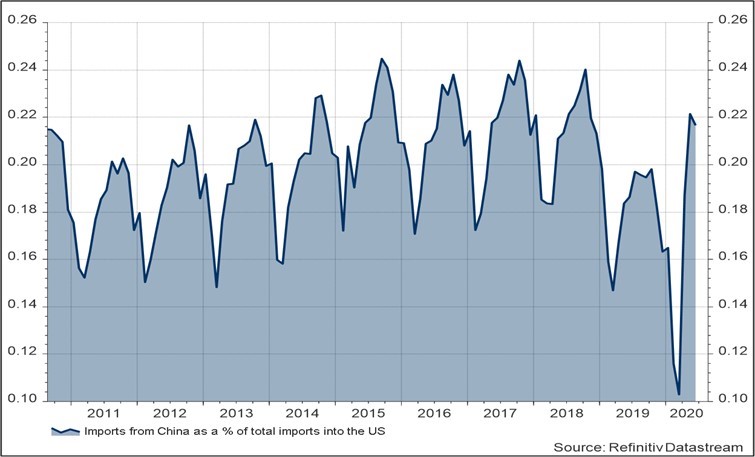

Since his speech, the Nasdaq and Shanghai stock indexes have risen by 9% and 2% respectively. Investors, it seems, are unconcerned about the possibility of an escalation of events between the two superpowers creating an immediate halt to economic relations. Indeed, despite Chinese imports into the U.S. in March showing a massive drop as a percentage of total imports, the June data released earlier this month indicates this has rebounded, although the levels are slightly down from previous highs.

Chart 1: Chinese imports as a percentage of total imports to the U.S.

Nasdaq’s recent bull run was related to strong near term trended profit growth as indicated in February’s note resulting in a substantial outperformance of other key benchmarks. Since the beginning of March, the Nasdaq composite has returned 33% followed by the Shanghai stock exchange at 19%. Investors at the long end of the U.S. bond market earned 11% which was the same for the global equity market, while all U.S. Treasury maturities returned 5%. Although some investors have begun to question whether NASDAQ is in another bubble, this outperformance was very much driven by rising expected profits, supported by falling interest rates.

Chart 2: Nasdaq versus other benchmarks since March 2020

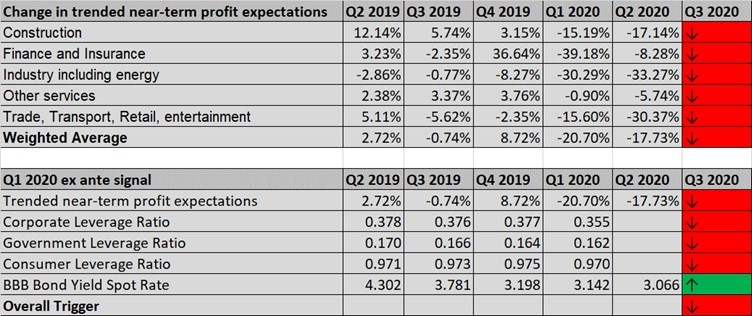

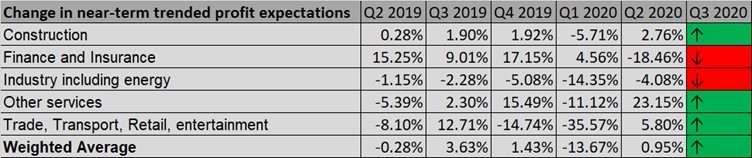

However, the August 2020 Credit Capital Advisory signal in Table 1 indicates that near term profits are now decelerating in the “other services” category, which contains the U.S. technology sector. Indeed, the U.S. market is now showing red across the board indicating exposure to U.S. equities is looking increasingly risky.

Table 1: Near term trended profit growth and leverage ratios – U.S.

Source: Refinitiv Datastream, Credit Capital Advisory

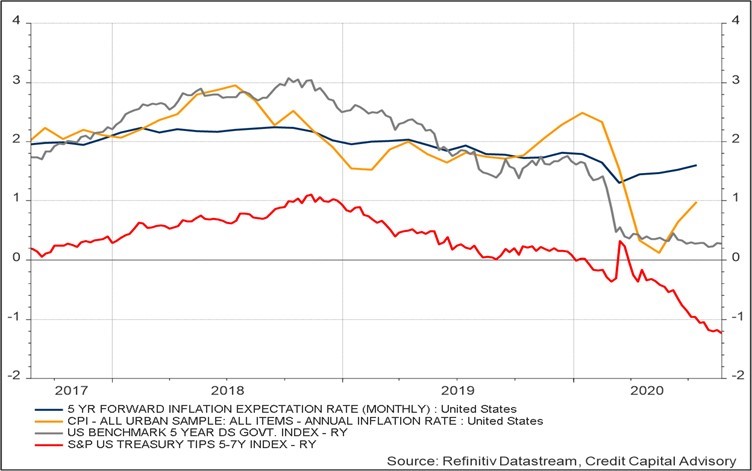

From an asset allocation perspective this raises the question of whether this should result in an increase in exposure to bonds. While performance to date has been good particularly at the long end of the curve, there remain risks in terms of future capital gain and negative real yields. Furthermore, there remains uncertainty on the trajectory of inflation due to the COVID-19 crisis.

Chart 3 indicates that while the market is expecting inflation to move to around 1.5% based on current TIPS spreads, long term expectations remain subdued which are likely to have been dampened by anticipated higher levels of unemployment. However, the problem of negative real yields is unlikely to go away any time soon, and while yields might fall further if equity markets move into reverse, the marginal gains are likely to be much lower given the current level of yields.

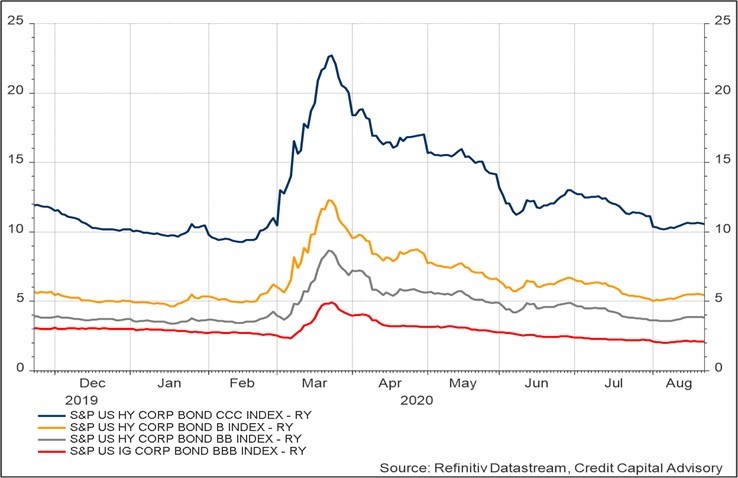

Chart 3: Inflation risks

Moving down the credit spectrum offers another alternative to generate incremental returns. Investment grade bonds continue to perfom well, although yields have been largely compressed by the Federal Reserve’s securities acquisition programmes. Curiously, although default risk in the CCC range is slightly worse than it was before the crisis, as is the case for B and BB bonds, it is not wider by much. Indeed, the bond market appears to be signalling that COVID-19 has had almost no material impact on the economy at all. The bond market, though, is not necessarily representative of the wider U.S. economy.

Chart 4: U.S. bond market indicators

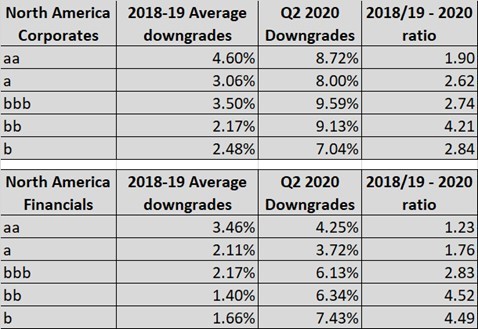

Data from Credit Benchmark, which aggregates bank estimates on the credit risk of issuers acoss the U.S. economy, shows a significant downward trend in the credit worthiness of a universe of 55,000 corporate and financial firms. Exhibit 6 shows that the level of downgrades during Q2 2020 has jumped substantially when compared to the 2018-19 period. The increase in the rate of downgrades has jumped almost five-fold in lower credit quality categories. The downward transitions from single B corporates are likely to have been impacted by the tendency of banks to churn lower quality issuers that may default.

Table 2: Comparison of downward credit transition rates U.S.

Source: Credit Benchmark, Credit Capital Advisory

The effect of this substantial worsening of credit quality, particularly across sub-investment grade issuers, suggests the bond market is largely oblivious to the underlying economic weaknesses of the U.S. economy. As defaults rise, so will unemployment, driving down demand for goods and services across the economy.

Given this negative outlook for the U.S. economy in terms of both profits and defaults, the question is whether other alternative assets might generate higher returns. An analysis of the Chinese equity market indicates that near term profit expectations are up overall, although this is not the case for finance and industry. Traditionally the rate of profit in China has been low which is why its stock market has performed poorly for many years. Indeed, the current level of the Shanghai index is where it was in early 2015 before it embarked on its dot com boom and bust. This shift towards profitable growth appears to be most concentrated in Other Services which includes the technology sector.

Table 3: Near term trended profit growth – China

Source: Refinitiv Datastream, Credit Capital Advisory

As a result of the turnaround in profit growth in China and the decline in profit growth in the U.S., the near-term outlook appears more bullish for Shanghai than for Nasdaq. This assumes that the ongoing tension between the U.S. and China is more of the same; bellicose rhetoric but without the follow through. The complexity of the U.S.-China relationship makes action hard, as Secretary Pompeo has recognized, and attempts by the U.S. to bring its traditional allies on board may be even harder given the deterioration of these relationships over the last few years.

While the souring of international relations is likely to continue, so will the battle between the two stock markets. And in the near term at least, Shanghai may have the edge.