In July 2007, the equity market was forecasting strong earnings growth with the S&P 500 breaking new highs. More importantly, credit markets were signalling that credit risk had largely been conquered. The credit default swap for Greece was just over 4bp compared to just under 2bp for Germany, indicating that credit markets had stopped distinguishing between the credit quality of issuers. Within 12 months, quite a lot had changed. Markets had demonstrated that while they might be micro-efficient, they are certainly not macro-efficient. Trouble, it seems, comes from where you least expect it.

Credit compression

The phenomena of credit compression where the yields of risky assets converge with much safer assets is generally associated with the end of credit cycles. One of the negative side effects of a monetary policy geared towards stabilizing inflation is that it can lead to a cumulative expansion of excess credit into the economy. This tends to have a downward effect on interest rates, which in turn affects investor behaviour. Falling yields result in asset-liability mismatches for investors, which in turn drives investors to increase their risk exposure to maintain expected returns. Furthermore, investor demand for marginally higher- yielding products is generally satisfied by the market, which finds innovative ways to package new higher-risk products.

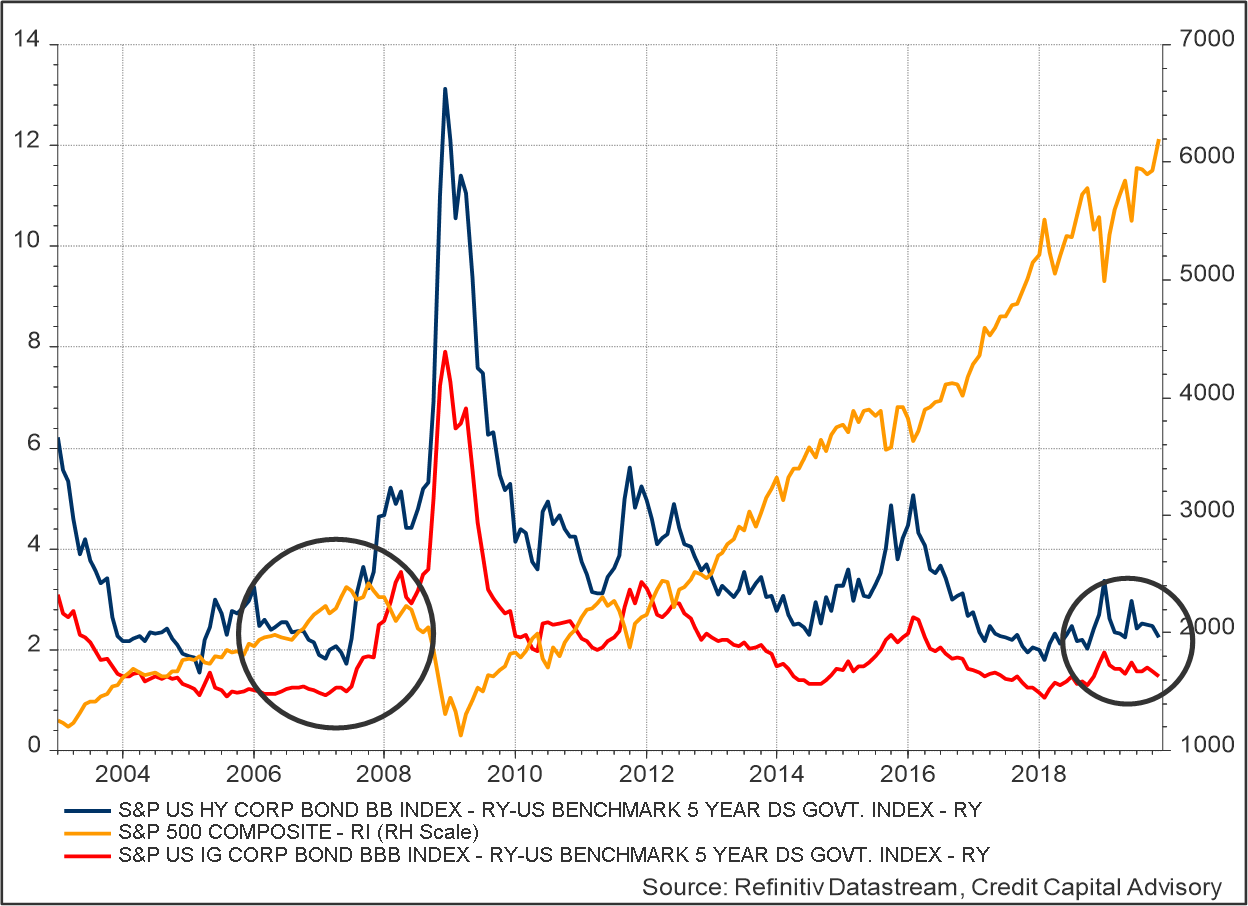

In 2007 at the height of the credit compression in June, the difference between the yield of BB and BBB bonds fell to just 0.7% despite the fact that default rates are three times higher for BB according to S&P. This increased credit compression was subsequently followed by new equity highs in October 2007 before yields jumped and the equity market collapsed.

Fast forward to November 2019 where the average between BBB and BB yields is now close to 0.8% and equities have once again reached new highs. This would be fine for investors if BB credits were unlikely to deteriorate, but such an assumption is based on wishful thinking rather than any hard analysis. Highly leveraged issuers will see their perceived credit quality deteriorate once profits start to fall, impacting their ability to pay back their debt. This will most likely cause yields to widen and equities to fall.

Chart 1:Credit Compression of BB vs BBB spread over Government Benchmark and S&P 500 (US)

Ongoing negative profits outlook

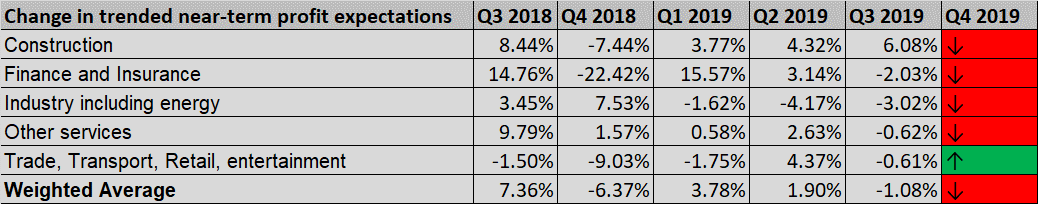

Despite record highs and a general bullish sense pervading the equity market, the prognosis does not look positive for earnings growth at all. Actual profit growth and profit growth expectations have been falling since the end of February 2019, just as they were throughout 2007. Indeed, near term profit growth expectations is falling for virtually all sectors with the exception of trade, transport, retail, entertainment which remains buoyed by consumer spending.

Table 1: Near term profit expectations (US)

Source: Datastream Refinitiv, Credit Capital Advisory

Moreover, consumers do not see a positive outlook ahead as they continue to deleverage and reduce their risk, while firms’ rate of investment in relation to their debt is also down, indicating they see fewer opportunities ahead for decent returns. The negative outlook for profits matters, because falling profits will impact the ability of highly leveraged firms to repay their debt. Furthermore, if profits continue to fall, this will most likely lead to a jump in defaults and an increase in credit risk, particularly in the BB category.

Table 2: Macroeconomic indicators (US)

Source: Datastream Refinitiv, Credit Capital Advisory

Credit cycle investing returns

This framework for understanding equity and bond returns in relation to profit growth and leverage enables investors to navigate the credit cycle. As near-term profits rise, investors should shift their allocation of capital to equities, and as near-term profit expectations fall investors should shift in to bonds. While credit cycle investors have missed out on the recent rises in equities, returns are still robust for the year at 20% with the switch from equities to bonds made at the end of February.

Buy and hold equity investors are up 26% year to date versus only 8% for bonds. The challenge for a buy and hold strategy is that the credit cycle amplifies both the gains and crucially the losses. Hence periodic large scale capital losses have a substantial impact on long term returns which is why credit cycle investing continues to outperform equity and bond buy and hold returns in the long run.

Chart 2: Equity and bond returns YTD

Here comes trouble

As mentioned in last quarter’s note, leveraged loans – particularly issued by private equity owned firms – are looking increasingly vulnerable to the slowdown in profits. Hence CLO investors may find that if the pool of loans has a greater concentration of private equity owned issuers, credit deterioration may start to accelerate, causing the value of the CLO tranches to fall, and potentially some of the lower rated tranches to default.

Credit compression gives investors a false sense of security because it suggests that the risks of credit exposures have been conquered. This is clearly not the case for highly leveraged issuers and should be rather interpreted as a sign that the market is about to spring into action, an action that will not be positive for equities or high yield bonds.