On the ground floor of the Richelieu wing of the Louvre Museum is an obelisk which depicts the recorded minutes of a government’s credit policy decision from over 4,000 years ago. The Manishtushu Obelisk, written in cuneiform, denotes that the interest rate for borrowing barley was 33% and for borrowing silver was 20% across the Akkadian Empire which is in modern-day Iraq.

The basic concept of current interest rate theory is that the money rate of interest will fall to equal the flow of income from an asset. According to the American economist Irving Fisher, if the return on capital is say 10% and the money rate is 5%, then loans will be made for projects until the marginal return on capital equals the rate determined by the supply and demand for loans. Fisher argued therefore that there could not be a sustained significant difference between the return on capital and the cost of capital.

With this discrepancy now resolved, Fisher thought that the real rate of interest was more important whereby economic agents estimate real rates of interest based on their view of inflation. Hence a nominal long-term bond yield plus the expected rate of inflation will produce the real rate of interest thereby enabling the interest rate mechanism to coordinate the inter-temporal decisions of households and firms. If inflation expectations are expected to rise due overheating, then nominal rates will rise and conversely if inflation expectations fall due to an economy operating below its potential then nominal rates will fall.

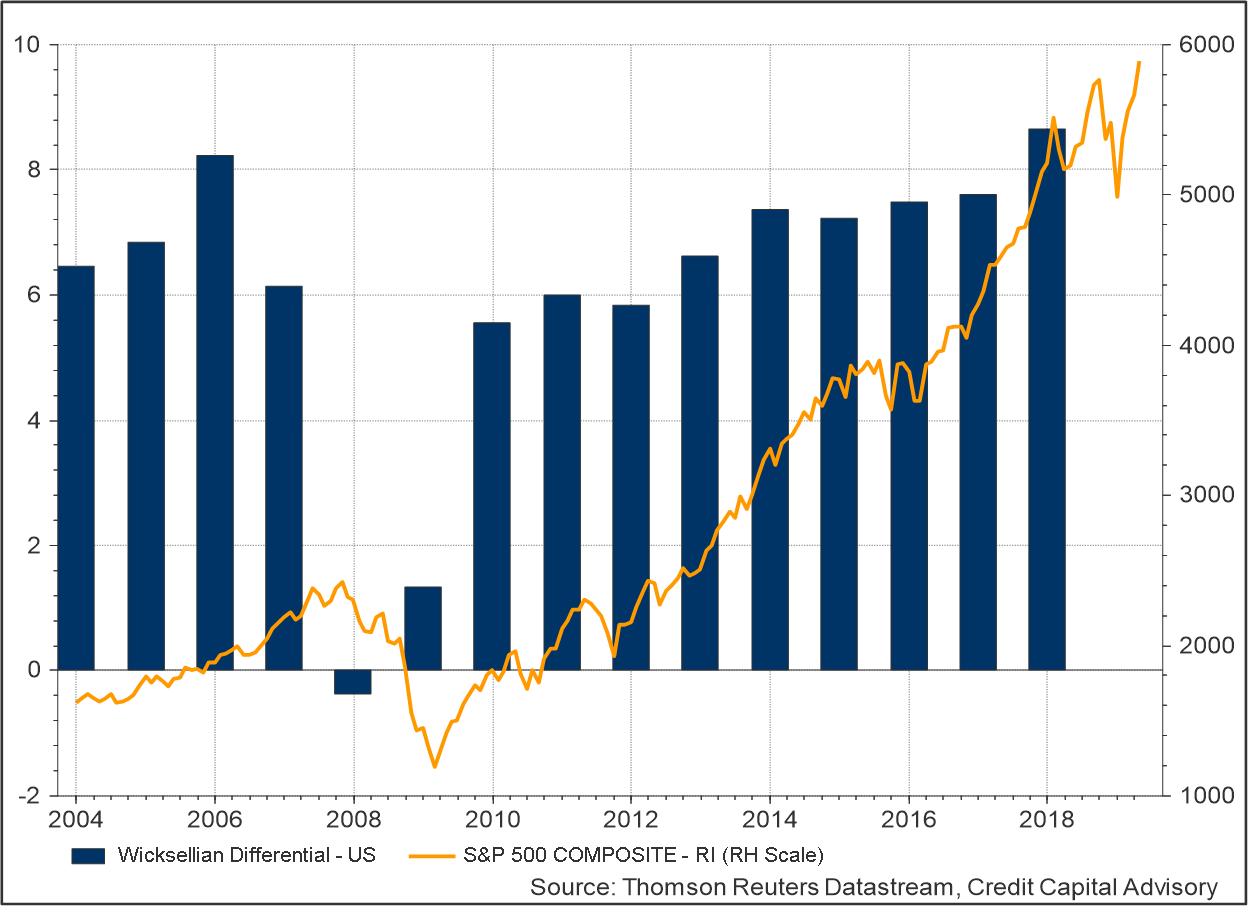

However, theory doesn’t always coincide with reality. Firstly, as noted by the Swedish economist Knut Wicksell, there were periods where the return on invested capital was different to the cost of capital. The difference between these two rates, known as the Wicksellian Differential, describes whether the rate of profit is increasing or falling.

The jump in the return on invested capital for the US economy for 2018 resulted in a record level of the US Wicksellian Differential despite the BBB cost of funding rising. The Wicksellian approach to understanding interest rates, which explains the longest equity bull market in history, is however completely at odds with the notion that the two rates converge.

Chart 1: US Wicksellian Differential vs S&P 500

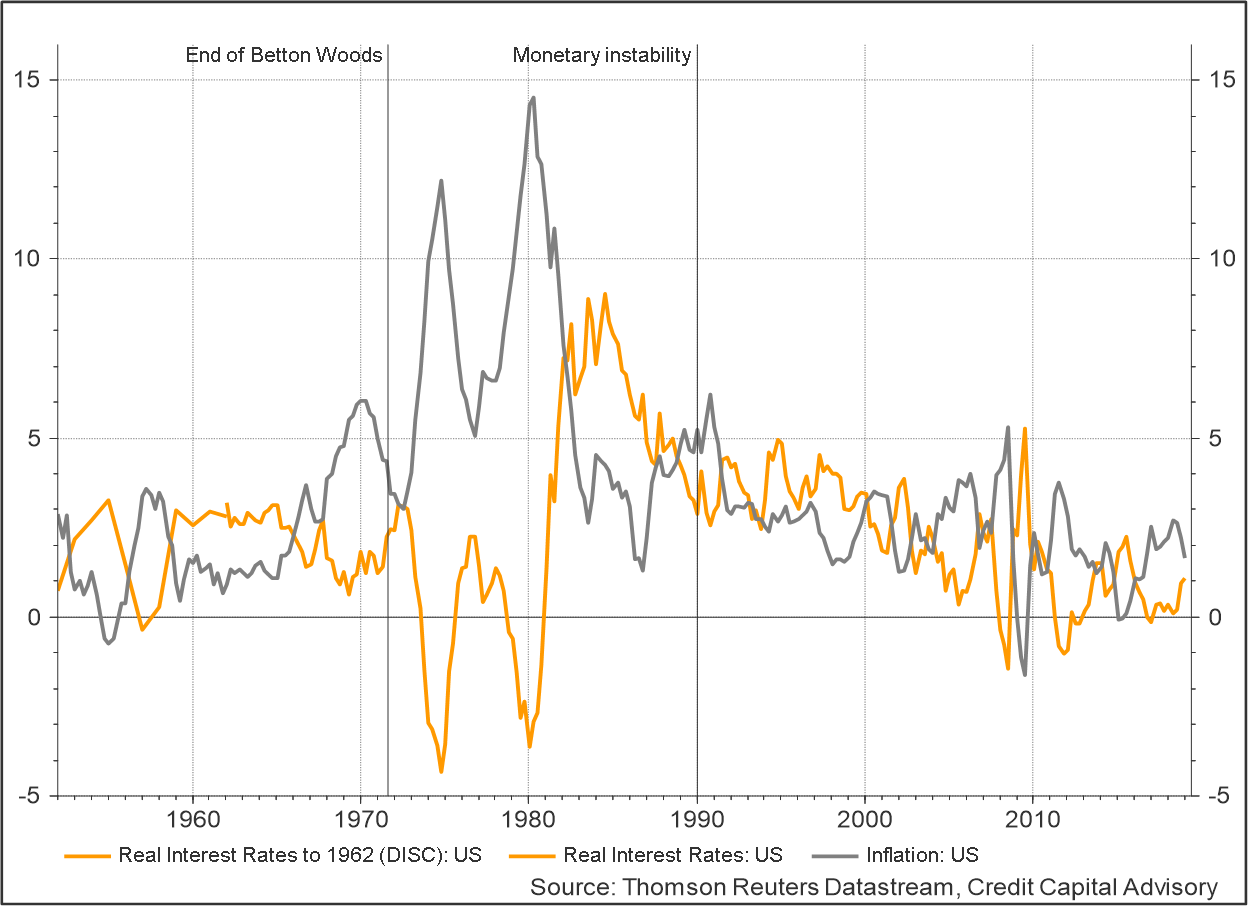

Secondly, the idea that the real rate of interest can indicate whether an economy is robust or floundering depending on whether it is generating inflation or not does not seem to fit the facts either. The fall in real interest rates since 1980 has led some such as the IMF to argue they are now low because of weak demand for capital, leading to lower trend growth combined with higher rates of saving in emerging markets which prefer to be invested in safe assets.

While real interest rates have indeed fallen dramatically since 1980, this is only because they jumped during the 1980s in order to control the rising inflation of the 1970s. US real interest rates since 2009 are only marginally lower than where they were during the long post war boom which was underpinned by the Bretton Woods regime. In essence, changes in monetary policy regimes mostly explain these issues as has been argued by the Bank for International Settlements. Once inflation expectations have been anchored, increases in inflation do not necessarily indicate an overheating economy and inflation may not increase even if excess credit has been injected into an economy.

Chart 2: US Real interest rates and inflation since 1950

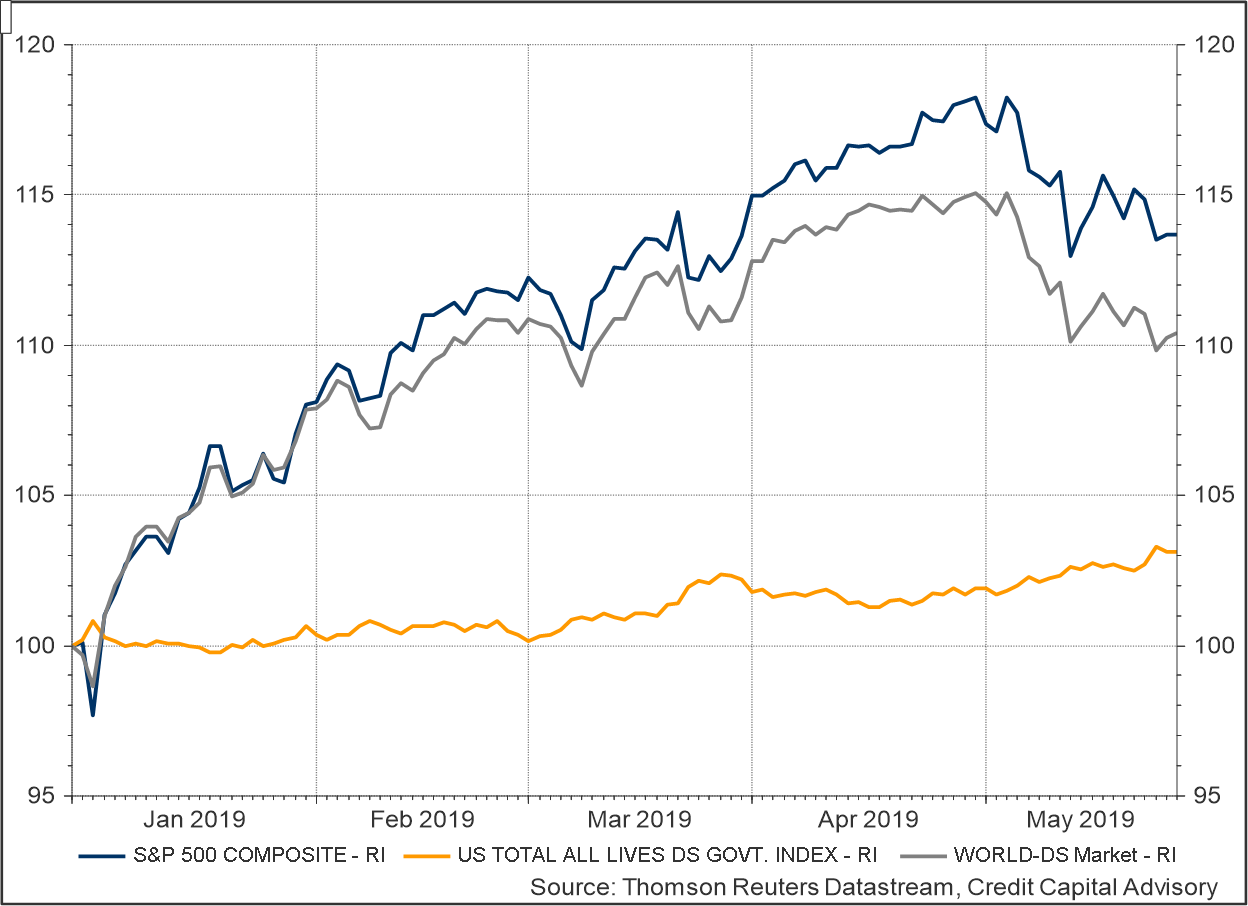

Active investors accepting both the convergence theory of interest rates and the secular stagnation narrative would therefore have missed the returns from the longest equity bull market in history. For buy and hold equity investors the last few years has worked well, however exposure to equities when the market falls leads to capital destruction.

In terms of forecasting any potential downswing, the signal was still positive during the recent downturn in December and only turned negative towards the end of February. Hence year to date this strategy has generated over 12.3% of equity return and 3.1% of bond returns totalling 15.4%, slightly more than the buy and hold strategy for US equities of 13.7%.

Chart 3: Year to date returns – S&P 500, US government bonds and global equities

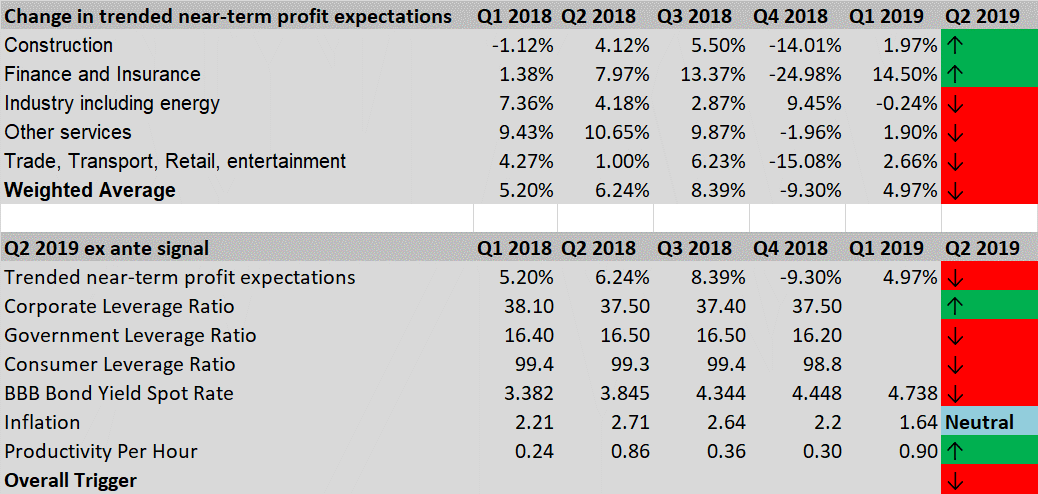

Clearly it is still theoretically possible that equity markets will boom once more. However, the outlook for profits is negative as shown in table 1, which in turn is more likely to have a negative effect on equity returns rather than a positive one.

Indeed, most sectors are indicating a decline in near term profit expectations with the exception of finance & insurance and construction, although construction accounts for only 6% of the economy. In terms of credit cycle activity, although corporate sector leverage has marginally ticked up, it is demonstrating little desire to borrow to invest, indicating limited future increases in consumption. Given that consumers are continuing to deleverage, it suggests that this strategy is an appropriate one.

Table 1: Near term profit expectations and credit cycle outlook

Source: Refinitiv Datastream, Credit Capital Advisory

The polarisation of narratives about the economy and the stock market are making it increasingly difficult for investors to decide whether to allocate assets into equities or debt. This is why monitoring the two key interest rates is so important and why investors need to largely ignore current interest rate theory. Indeed, attempting to make sense of the 4,000 year old credit policy minutes provides further support for investors to junk the theory.

Interest rate theorists have generally argued the reason why the rate of interest in silver was so much lower than on barley was that the returns to barley were so much higher. But this makes little sense given that barley wasn’t loaned for entrepreneurial activity but rather provided to farmers when the harvest failed, with aim to pay the loan back from future harvests. The reality is that the weather didn’t always support this and hence the government periodically decided to write off barley loan debts.

Loans based on silver, which were lent to merchants for trading, were not subject to government support and theoretically might give some insight into the relative profitability of trading. However, if a merchant defaulted on the loan, he had to hand over his family as slaves which largely explains why projects at the margin are rarely countenanced. 4,000 year old credit policy minutes can still provide investors with insight into the nature of interest rates, which is central in generating higher returns than buy and hold.