In December 1978, the cargo ship MS München, carrying steel across the Atlantic to Savannah, Georgia sank. At the time the cause of the tragedy was unknown. Although the ship was ploughing through a winter storm, the significant wave height predicted by the Rayleigh distribution indicated that ocean conditions shouldn’t have unduly troubled the vessel.

Our understanding of complex systems has improved significantly since the 1970s, particularly the idea that linear systems can break down resulting in nonlinear effects. In oceanography, it has now been established using a nonlinear Schrodinger equation that individual waves can absorb the energy from other waves leading to the formation of freak waves, which resulted in the sinking of the MS München.

Stocks markets and freak waves

When thinking about stock markets, if one believes an economy merely oscillates around an equilibrium then investors don’t need to be overly worried about the ups and downs of the market. It’s a bit like a shipping company not having to worry about freak waves. However, the evidence demonstrates this is not how complex systems work. Economies tend to move in cycles, which can lead to dramatic changes in capital values.

In an economy, excess credit growth acts as a destabilizing mechanism, just as kinetic energy does for waves. Hence an excessive amount of credit released into an economy can lead to an economic system becoming unstable, generating nonlinear effects.

The theory of credit cycles was expounded by Knut Wicksell in his seminal work Interest and Prices published in 1898. Wicksell argued that excess credit in an economy is the reason behind the oscillations of cycles that can be measured by the difference between the return on capital and the cost of capital. As the difference between the return on capital and the cost of capital increases – known as the Wicksellian Differential – equity prices tend to rise. And when the difference decreases, equity values tend to fall.

U.S. and China comparison

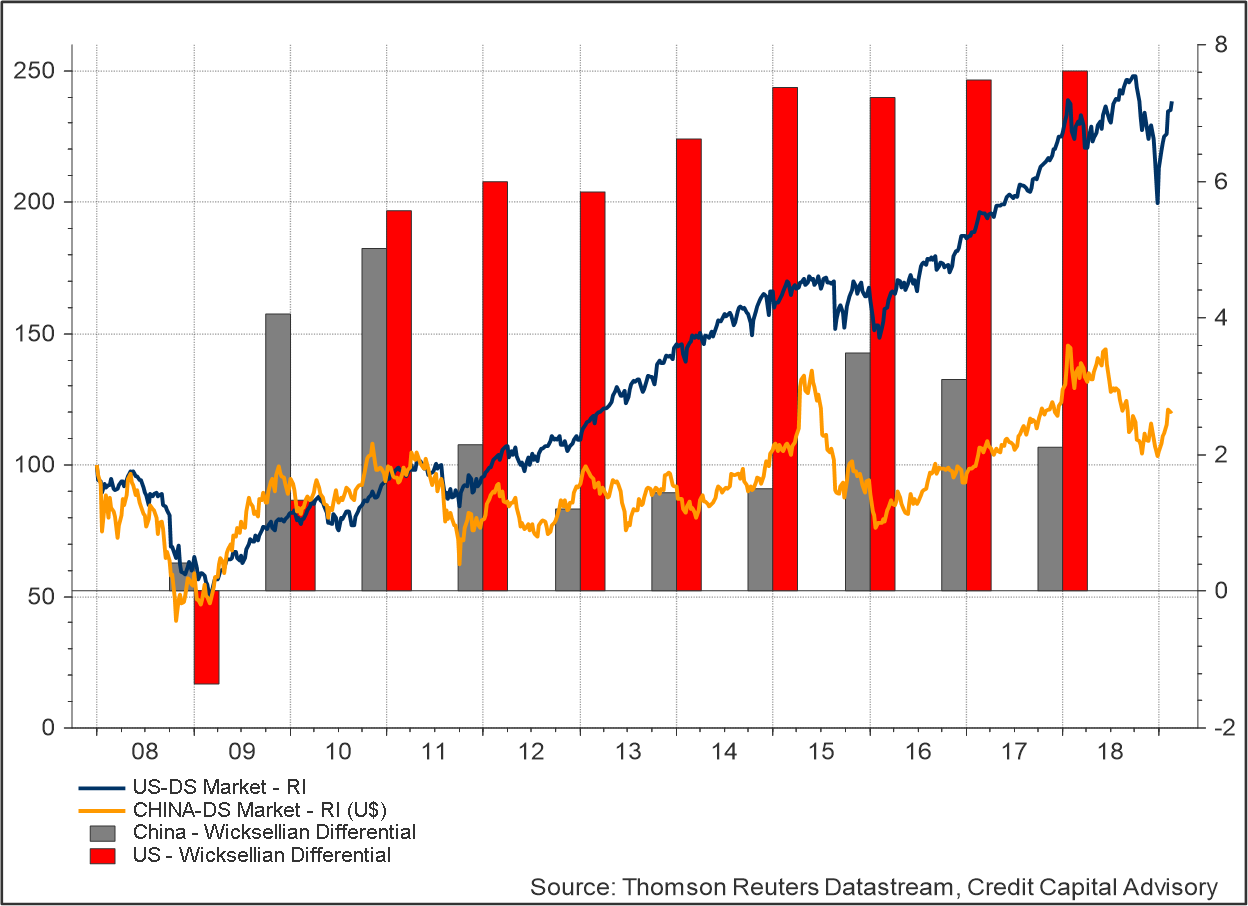

A comparison of the Wicksellian Differentials between the U.S. and China since 2009 shows the relationship between rising and falling profit growth and equity values, and also explains why the U.S. market substantially outperformed China.

From the trough of the financial crisis in early 2009 through to the end of 2010, the U.S. and Chinese stock markets grew at similarly rates as both their Wicksellian Differentials increased. However, in 2011 China’s Wicksellian Differential crashed, and apart from a jump in 2015, it has generally been on a downward trend, indicating declining profit growth. In contrast, despite two small dips in 2012 and 2015, the U.S. Wicksellian Differential has been large and rising.

The two U.S. downturns in the credit cycle in 2012 and 2015 lasted just a year and neither caused investors much concern. Equity markets were up double digits in 2012 despite the negative outlook and they only fell 1% in 2015. Furthermore, subsequent to both these downturns in the credit cycle, equity returns boomed.

Chart 1: U.S. and China equity returns vs Wicksellian Differentials

Credit cycle moves into reverse

Investors in U.S. and Chinese stocks appear to be in a buoyant mood over the future of equity values largely due to the prospect of an end to the current trade impasse. However, the ex ante signals for the Wicksellian Differential are now indicating that trended near term profit expectations are declining for both the U.S. and China.

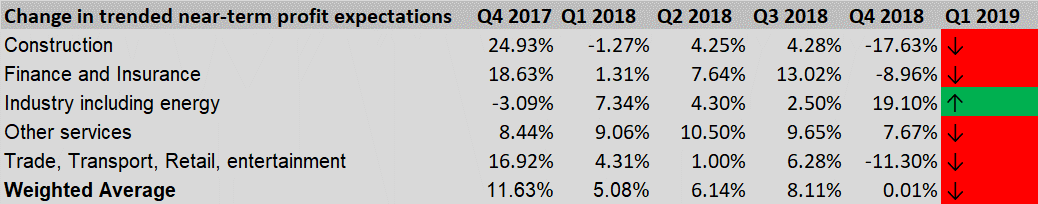

Table 1 shows that near term profit expectations for the U.S. economy are now expected to fall for nearly all sectors with the exception of industry including energy. Lower profits generally result in less demand for credit, given that firms are less likely to be in expansionary mode. The macroeconomic outlook is also negative with a decline in the corporate leverage ratio implying that firms are less willing to borrow to invest due to their perception of future lower demand, along with subdued consumer leverage.

Table 1: Near term profit expectations – U.S.

Source: Refinitiv Datastream, Credit Capital Advisory

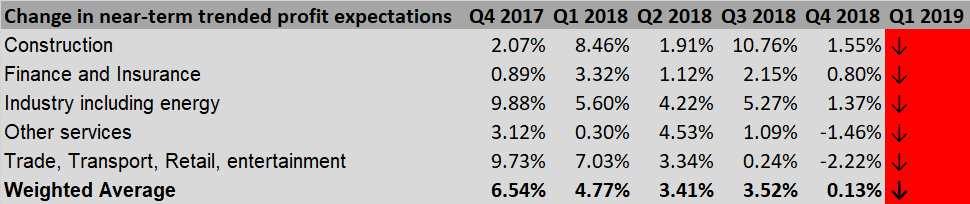

The trended near term profit expectations are also negative for China, where all sectors have a negative outlook.

Table 2: Near term profit expectations – China

Source: Refinitiv Datastream, Credit Capital Advisory

Shift rather than blip

So does this downturn in the credit cycle indicate a broader downward trend for the U.S. equity market or merely a repeat of 2012 and 2015? When the MS München sank, sufficient kinetic energy within each wave was in turn absorbed to create a rogue wave. The longer an economy is in the throes of an excess credit expansion and the larger the Wicksellian Differential, the likelier that poor credit decisions will have been made resulting in a greater potential for nonlinear effects. In essence, there is now a much higher probability that the signal is indicating a shift rather than a blip.

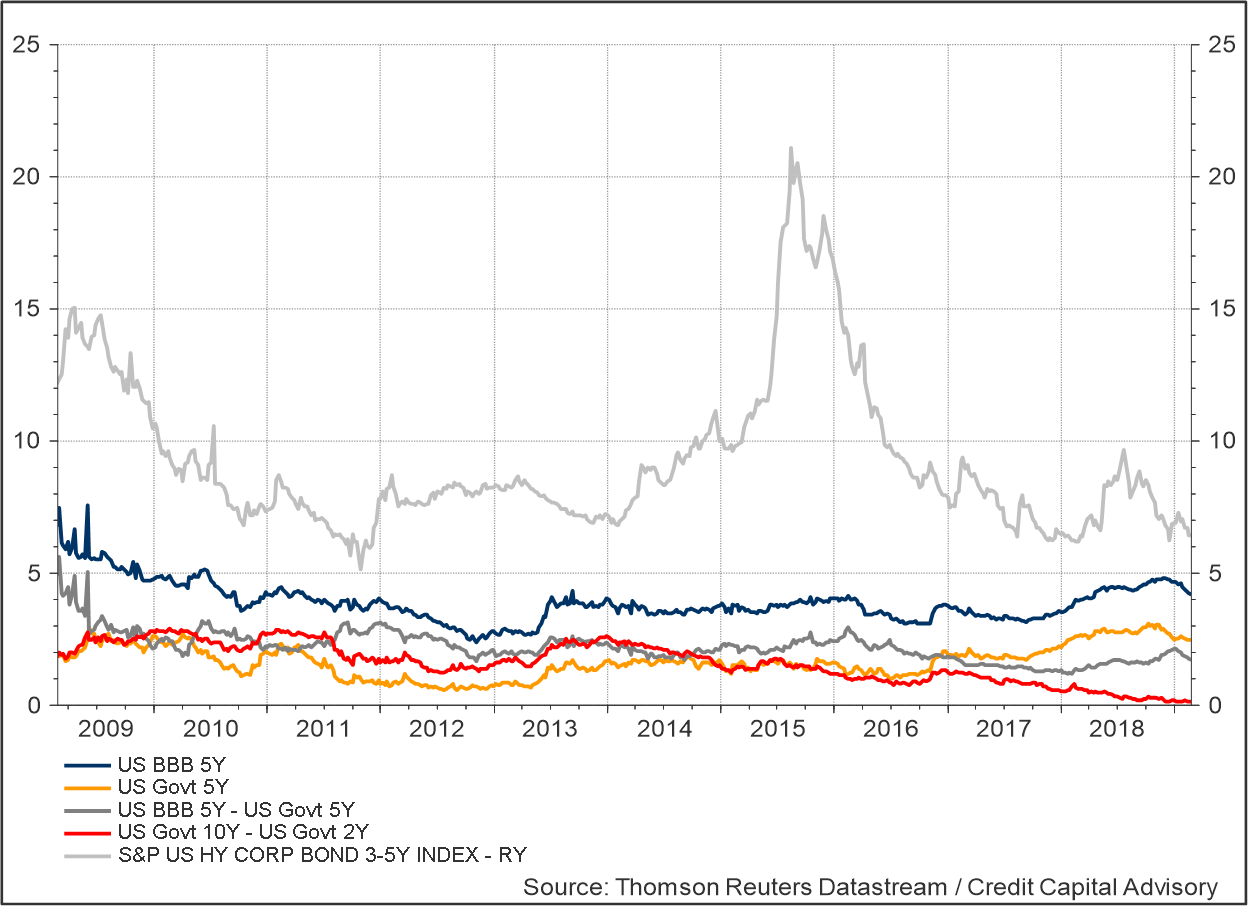

Historically though, equities have continued to rise for as much as a year after the downward shift in the cycle. Furthermore, given that Fed is less likely to hike short term interest rates and the five-year BBB and high yield levels remain stable as shown in chart 2, the market does not appear to be signalling a dramatic shift any time soon.

Chart 2: U.S. Bond Market Indicators

The challenge for dynamic asset allocation is that predicting the exact turning point of the market is like trying to predict when a freak wave might sink a ship. Recent research undertaken at MIT indicates that freak waves can be predicted, but only by a matter of minutes. Investors have been warned.

Trackbacks/Pingbacks