Liberal democracies force individuals to have moral opinions about the world we live in. Every few years, as the economist Joseph Schumpeter put it, citizens decide which elite best represents their point of view via the ballot box. Therefore, it is natural for voters (and investors) to want the political parties that agree with their world outlook to succeed, and the parties they oppose to fail.

The challenge for investors is to remove this built-in cognitive bias from investment decisions and to focus on market fundamentals rather than political posturing. For example, following the conclusion of the Mexico – US trade deal in August this year, the stock market jumped to new highs. Trump supporters claimed this was a vindication of his approach to trade deals. Subsequently, Trump opponents have argued that the recent 10% fall from all-time highs was due to his disruption of global trade. Such explanations are mostly unhelpful and generally misleading.

It’s all fake news!

The American thinker Walter Lippmann in the 1920s wrote that we misunderstand the limited nature of news, the illimitable complexity of society and, crucially, that we overestimate our own endurance, public spirit and all-round competence.

Lippmann argued that news and truth are not the same thing, implying that all news is fake to a certain extent – not just the news that presidents don’t like. News, of course, tells stories to chime with our world view, which often makes villains and conspiracies out of things we oppose. As Lippmann quipped:

“If a closely fought election is lost, the electorate was corrupted; if a statesman does something of which you disapprove, he has been bought or influenced by some discreditable person. If workingmen are restless, they are the victims of agitators; if they are restless over wide areas, there is a conspiracy on foot.” And my personal favourite, “If you do not produce enough aeroplanes, it is the work of spies.”

Investors therefore need to ignore the news flow and instead continually assess streams of data in relation to the drivers of the return on and cost of capital. Such an approach for 2018 would have meant being invested in US equities.

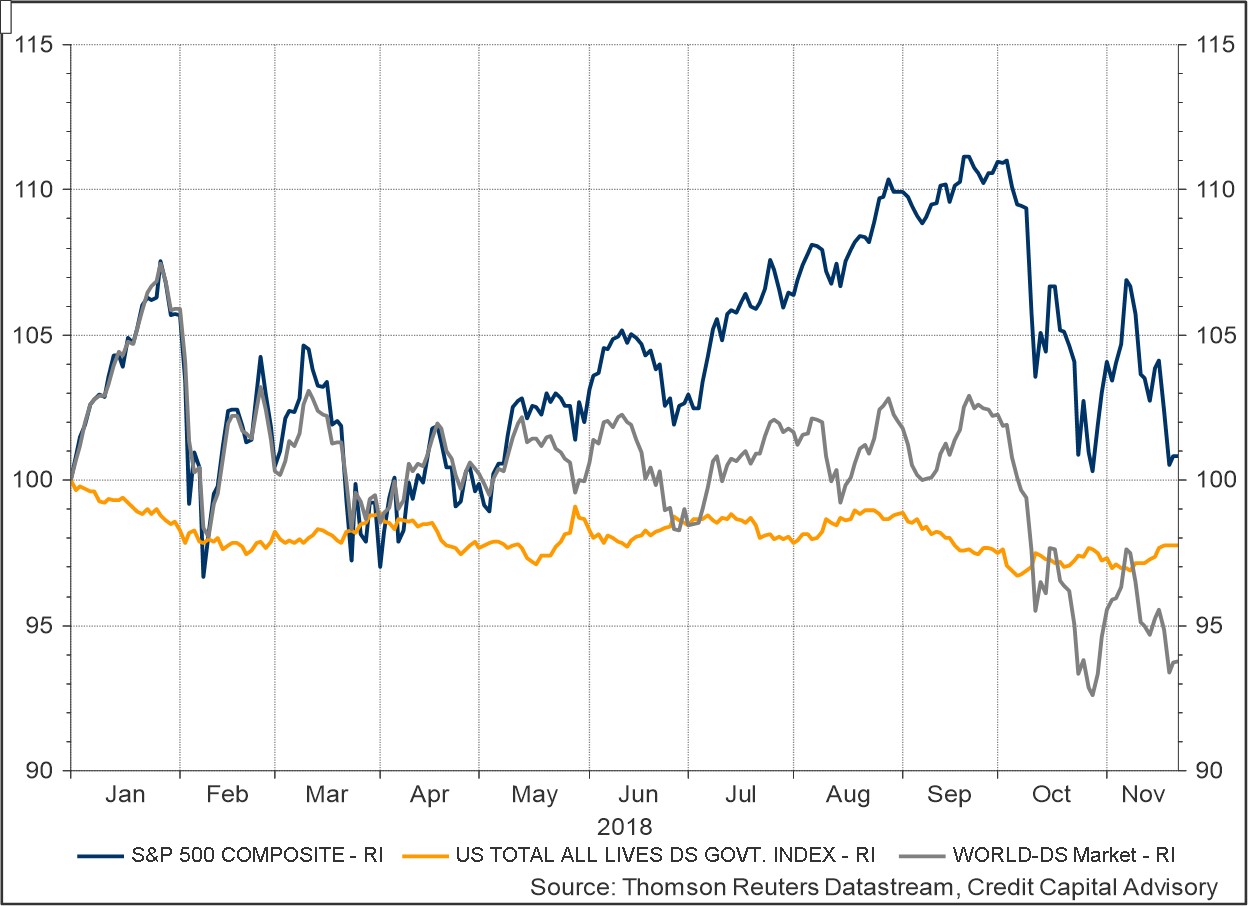

Not a great vintage, but better than the rest

US equities have had something of a roller coaster ride with returns barely up on the year. However, when analyzed from a comparative perspective, they have performed rather better given the capital destruction of US Treasuries and global equities. But are recent falls in market capitalization signalling a shift in the credit cycle or should equity investors sit tight and wait for the longest bull market in history to tick up once more?

Chart 1: US equity, global equity and US Treasuries YTD returns

Streams of data

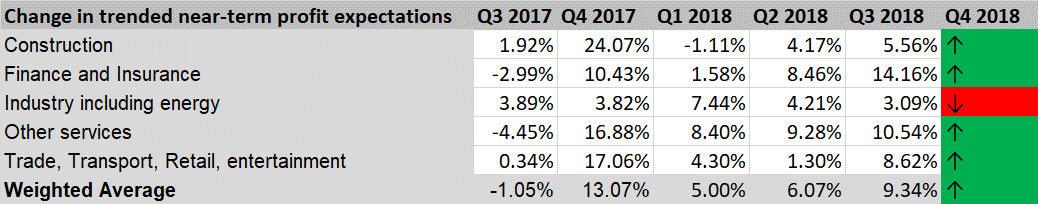

The Q4 Credit Capital Advisory US asset allocation model is still signalling a positive profit outlook for all sectors except for industry (including energy). This indicates that future profits can be expected to rise and the return on invested capital or natural rate of interest for 2018 is likely to be higher than the 10.76% of 2017.

Table 1: Near term profit expectations – US

Source: Refinitiv Datastream, Credit Capital Advisory

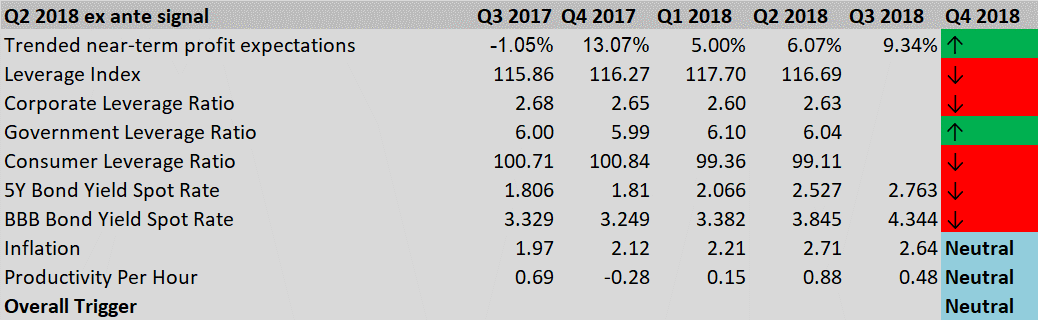

Although the outlook for profit growth is still positive, the macro outlook is less rosy. The negative shift in leverage indicates that economic agents are borrowing less to invest and consume, implying that their expectations of future consumption and earnings are lower. Such an outlook is in keeping with the final phase of the credit cycle. It is however worth noting that equity market declines during the dot-com crash and the financial crisis were preceded by both a decline in profit outlook and in leverage, in addition to a robust economic outlook!

Table 2: Macro indicators – US

Source: Refinitiv Datastream, Credit Capital Advisory

It’s the bond market, stupid

Of central importance in assessing whether the Wicksellian Differential might fall, indicating a decline in capital values, is whether the cost of funding will rise faster than profits. The current 5 year moving average cost of funding is now at 3.72%, which will require the return on invested capital to break 11% this year to maintain upward pressure on capital values.

The BBB 5 year yield has widened along with the government benchmark, however the spread between the two remains just below the historic average of around 2%. This does not indicate a serious deterioration in credit quality. In addition, the 10 to 2 year government spread has not inverted either, so the bond market is not signalling Armageddon. However, should BBB yields continue at current levels, then it may well require a much faster rate of profit growth than is currently observable to maintain growth in the Wicksellian Differential.

Chart 2: US bond market indicators

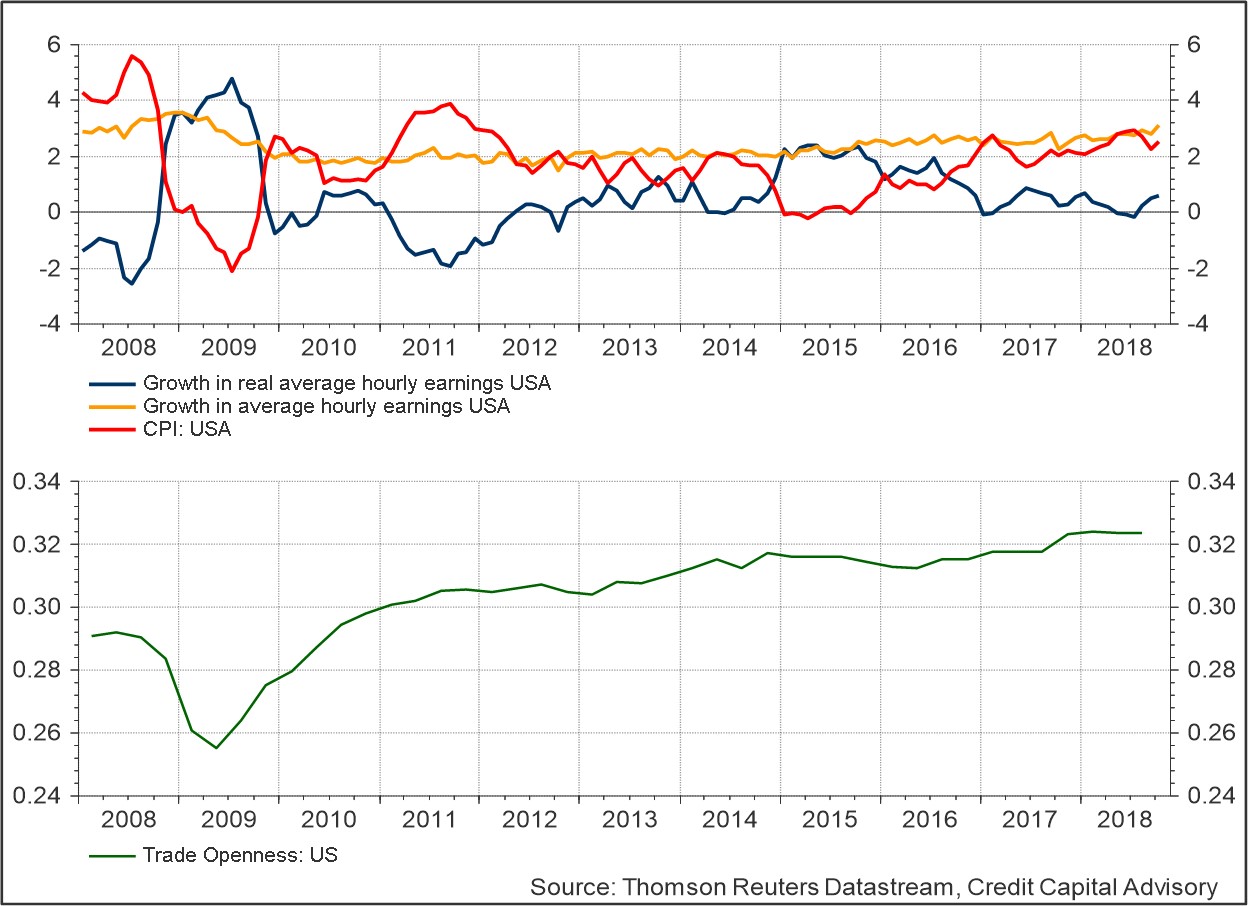

Peaking yields?

Other macro data suggests there is less upward pressure on yields due to less inflationary pressure. Despite the ongoing disruption to global trade, which has led to some rejigging of global supply chains, US trade openness remains close to all-time highs. Furthermore, although recent nominal wage growth has ticked up slightly, real wage growth remains sluggish.

Chart 3: US Labour Market indicators & Trade Openness

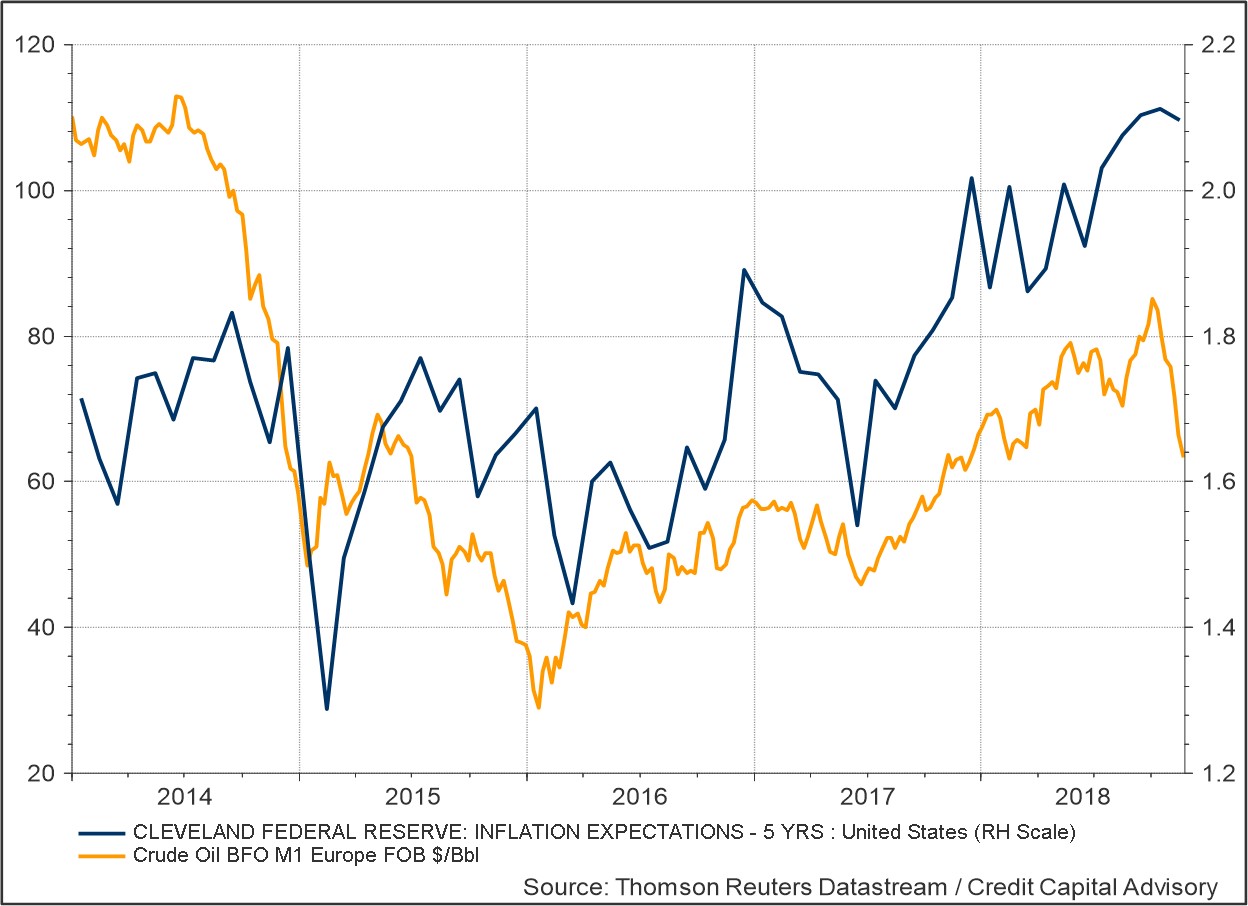

In addition, the recent fall in the price of oil has also begun to depress inflation expectations. This is likely to at least cause the Fed to question the need to raise short term interest rates in the immediate future. It has been argued that the recent fall in the price of oil is due to a negative aggregate demand shock. But for this to be true, it would also need to be true that a positive demand shock was the reason why oil prices rose from $70 a barrel to $85 a barrel between August and October. Technical factors are more likely to be the reason for such short-term market moves, and the current difference between $70 and $60 does not suggest a clear aggregate demand shock.

Chart 4: Brent oil vs US 5Y inflation expectations

We are all biased now

There is not much data that indicates that the market is about to crash or to soar to new levels. Markets can go sideways as well as up and down. But if BBB bond yields remain at their current levels, then we are likely to see a decline in the Wicksellian Differential unless profit growth accelerates, which seems unlikely given the decline in leverage activity.

Finally, why do I place so much emphasis on the bond market? As a macro-credit strategist, it would be odd if I didn’t. Eliminating all bias is impossible. But it strikes me that the bond market provides a much better anchor point for investment than the stories that happen to support our world view.

Trackbacks/Pingbacks