American trade policy and free trade have rarely been bedfellows. President Trump’s arbitrary tariffs on imports of steel (25%) and aluminium (10%) announced on March 1st might be better understood as part of an American mercantilist tradition that stretches from Alexander Hamilton’s 1791 report on manufactures to the Smoot Hawley Tariff Act of 1930.

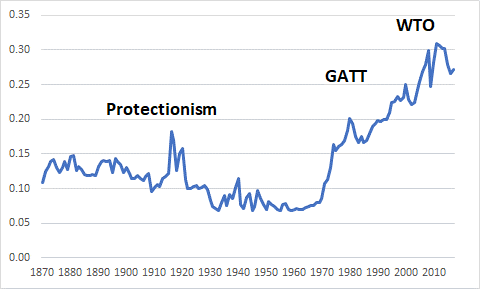

Indeed, the opening up of the US economy to international trade is a relatively new phenomenon. Trade openness defined as exports + imports / GDP only began a sustained improvement as a result of the Kennedy GATT round that concluded in 1967. This was subsequently followed by the Tokyo round (1979) and the Uruguay round (1995) which included the founding of the World Trade Organisation.

Hence, for the last 150 years, the US has been on the side of protectionism more than it has on the side of free trade.

Chart 1: Trade openness of the US economy 1870 – 2017

Source: Historical statistics, Thomson Reuters Datastream, Credit Capital Advisory

The shift away of support for free trade in America should perhaps not be surprising. The same thing happened to Great Britain in the late 19th century as imports began to grow faster than exports. Joseph Chamberlain, the then secretary of state for the colonies, campaigned strongly for tariffs on foreign imports with preference given to trade with the empire. Chamberlain however lost the debate with concerns about rising food prices playing a central role in his defeat.

Just as Britain’s trade deficit and anti-free trade rhetoric ballooned in the late 19th century, the same thing has been happening in the US since the 1990s. President Trump argues that a trade deficit is clear evidence of “unfair trade” and what is needed is “fair trade” instead. However, there is very little difference between “fair trade” and mercantilism given that both focus on the balance of trade.

Although the President’s “fair trade” argument has resonated widely across the US electorate such a policy clearly plays in to the hands of those who never really believed in free trade and of course for potentially less competitive domestic firms. Trump’s talk of a level playing field largely ignores the potential costs to American consumers, even if a trade war is somehow averted.

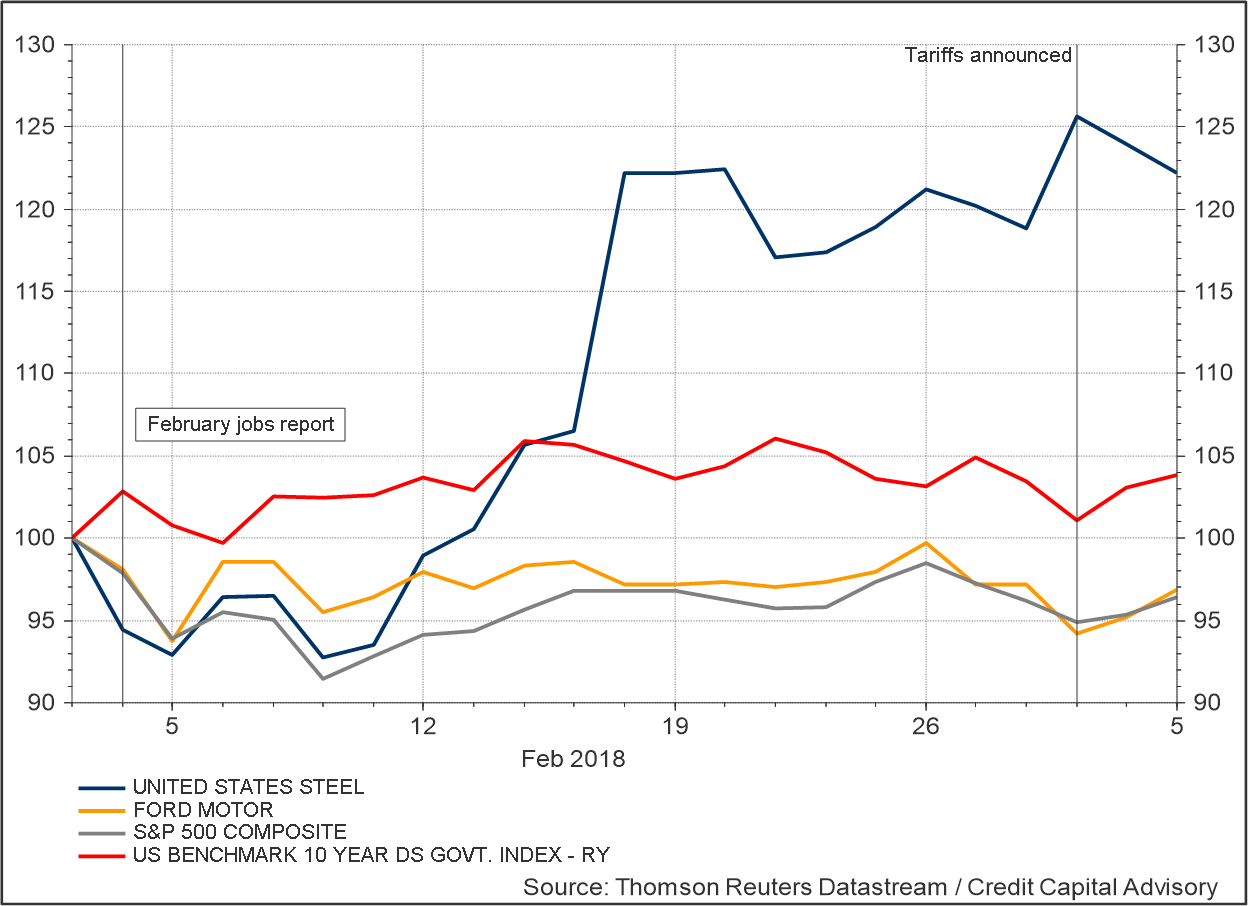

Chart 2 shows the rise in US Steel on March 1st compared to a fall in the S&P 500 and Ford Motor Company. Hence the market’s initial reaction is unsurprisingly that this would be bad for firms that buy steel, and in general for the wider economy. Bond yields though fell, suggesting the market believes that this is more likely to impact price levels rather than rates of change. In contrast, bond yields rose when the February jobs report was announced suggesting the market is more worried that the economy is close to rising above its “potential” with regards to inflation.

Chart 2: Response of US equity and bond markets to jobs report and tariff announcement

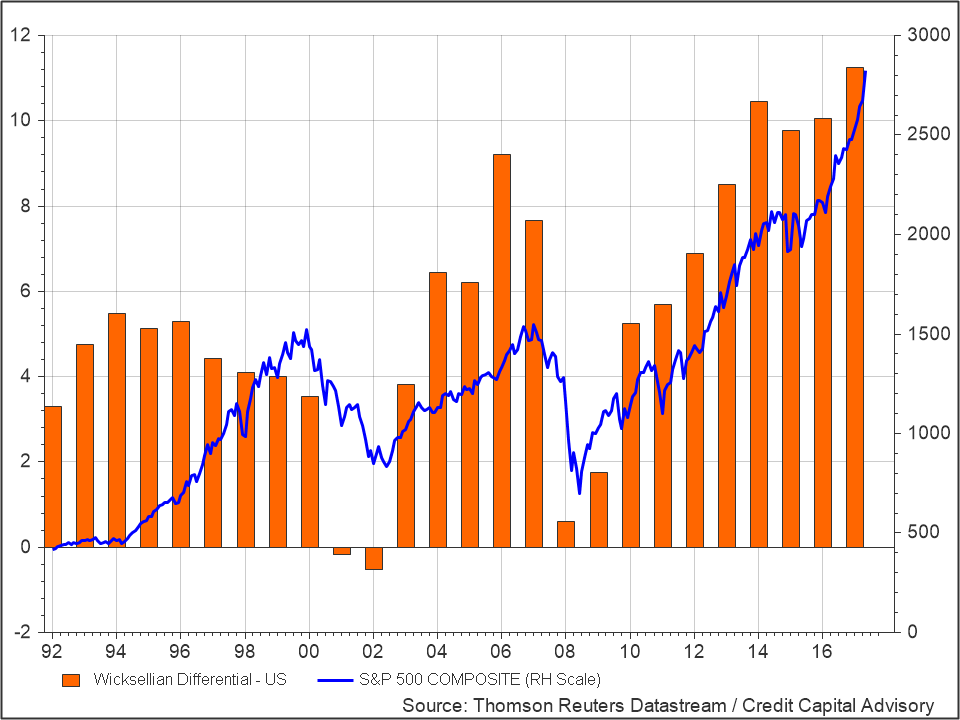

The direction of bond yields matters when it comes to the future direction of equity prices. If the cost of funding rises more than the return on invested capital then the US Wicksellian Differential, defined as the return on capital – the cost of capital, will begin to decline. A declining Wicksellian Differential tends to be associated with bear markets in equities.

Chart 3: US Wicksellian Differential & equity prices

But there are a number of reasons why bond and equity investors should be careful in just assuming that all that matters for rising bond yields is the economy growing above its potential thereby driving up inflation.

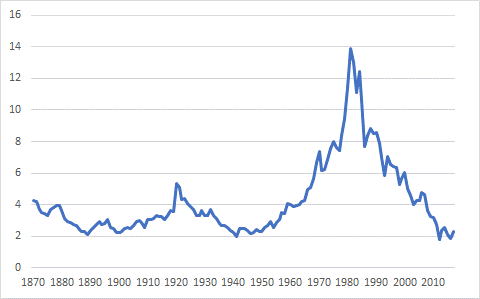

The first thing to note is that current 10 year bond yields are close to their long term average between 1870 – 1960, which was 3%. Too many commentators appear to be arguing that normal yields are much higher. But that is only the case if you take into account the period and aftermath of stagflation, which appears to be the exception rather than norm in the history of interest rates.

Chart 4: US long term bond yields (annualised)

Source: Thomson Reuters Datastream, Federal Reserve, Homer & Sylla, Credit Capital Advisory

The second thing to note is the falling cost of investment goods as argued here. The result of this is that as an economy begins to ramp up investment, it has less of impact on interest rates.

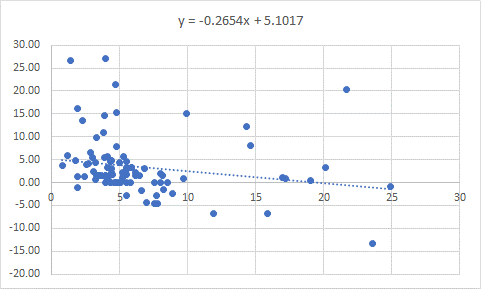

The third reason is the fact that the Phillips Curve has flattened considerably since China entered the WTO. A comparison of the Phillips Curve between 1870–1960 & 2001–2017 shows by just how much it has flattened.

Chart 5: Phillips Curve 1870-1960

Source: Federal Reserve, Thomson Reuters Datastream, Credit Capital Advisory

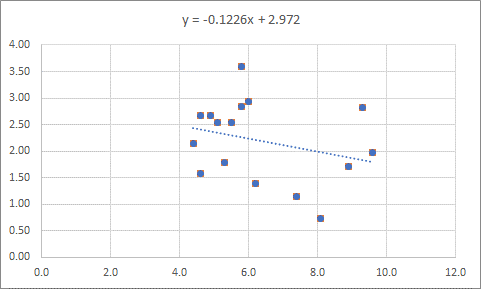

Chart 6: Phillips Curve 2002-2017

Source: Thomson Reuters Datastream, Credit Capital Advisory

The much flatter slope of the more recent Phillips Curve implies that wage growth is unlikely to be inflation busting and therefore drive up inflation and bond yields. Indeed, Fed chairman Jerome Powell speaking to the Senate Banking Committee confirmed that there is no decisive sign of wage inflation.

One of the major reasons behind the flattening of the Phillips Curve was the entry of China into the WTO in 2001 which dramatically increased the trade openness of the US economy. A more open country will be more sensitive to shifts in global prices, and crucially that country’s labour market will also be impacted by the international division of labour placing less pressure on nominal wage growth. The Phillips Curve up to 1960 – with its protectionist backdrop – is why central bankers previously expected to see much faster wage growth as unemployment fell.

Given that trade openness has constrained nominal wage pressure, the recent imposition of tariffs on steel and aluminium suggests that the bond market might have the “inflation” trade the wrong way round. A reverse in trade openness will more likely steepen the slope of the Phillips Curve than an increase in output above the economy’s “potential”.

Trump’s eagerness to pander to vested interests in pursuing a mercantilist policy may well end up taking the US economy back to the 1970s with its vertical Phillips Curve. Such are the costs of returning America to its mercantilist tradition.