In his novel, “War and Peace,” Leo Tolstoy rants at the idiocy of the intelligentsia for providing simplistic descriptions of the causes of events. The view that France invaded Russia because Napoleon gave the order and as a result, 600,000 people followed him across Europe, greatly exasperated Tolstoy.

However, the idea that the collective will of the population is transferred to individual figures is still alive and kicking in the world of finance. Financial journalists often make similar assumptions when trying to explain the reasons for stock market movements.

Fantasy island

Since Nov. 9, 2016, many journalists have referred to the “Trump trade” as being the cause of the stock market’s rise. According to this narrative, President Trump’s promise of improving the economic environment for business has caused profit expectations to rise and hence the stock market to soar.

Such journalistic practices have been an absolute gift to a president who has demonstrated an uncanny ability to market his brand successfully throughout his business career. Recently the president tweeted “Stock Market has increased by 5.2 Trillion dollars since the election on November 8th, a 25% increase”

The fact that the S&P 500 grew 17% between February 2016 until the election, only marginally lower than the Trump trade of 19%, has been conveniently ignored as it does not fit the fantasy analysis.

Mere details

Despite the claims of journalists and the president, it wasn’t until Sept. 27, 2017 that some policy detail on taxation was actually provided. These include the proposal to reduce the corporate tax rate to 20% (slightly lower than the rate of tax that firms actually pay — around 24%). Comparisons to the statutory federal rate of 35% are misleading.

In conjunction with the lower rate, the Trump administration has also proposed to eliminate tax credits, although they will remain in place for R&D, and to partially limit the deduction of net interest expense for C corporations.

Finally, the proposals end the incentive to keep foreign profits offshore by exempting them when they are repatriated to the United States. To transition to this new system, the framework treats foreign earnings that have accumulated overseas under the old system as repatriated with the payment of the tax liability to be spread out over several years.

Priced in or out?

One obvious question for investors is whether these proposals are likely to ever see the light of day, given they will require the necessary support from Congress. In addition, it remains uncertain whether what is actually passed will increase the rate of profit growth for firms sufficiently to keep stocks rising. However, Tolstoy’s question is the one investors should really care about: what has really been the cause of rising equity valuations? The utterances of a president or the reality of the conditions impacting corporations day in, day out?

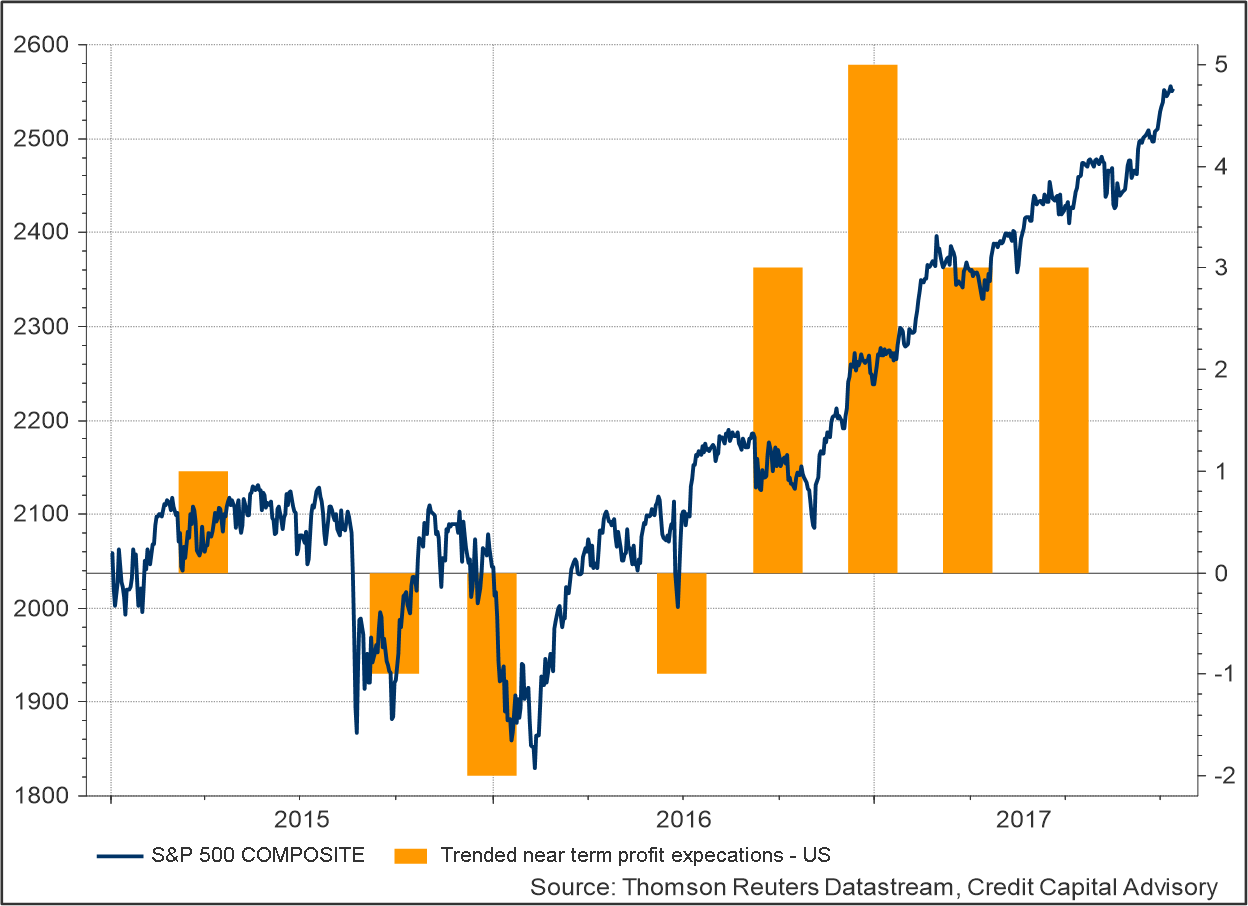

An analysis of the S&P 500 since 2015 and the trended profit expectations for the economy – which is derived from a weighted growth rate of net income by firm – shows the close relationship between the two. When the trended growth rate of net income falls, equities perform less well, but when the trended rate accelerates, equites rise.

Given that the basic valuation equation – the dividend discount model – is dependent on expected future cash flows, which is driven by profits, it is curious that journalists have ignored the fact that profit growth jumped in Q2 2016 and has maintained strong growth ever since. Instead they have cited President Trump’s utterances to explain the stock market boost.

Chart 1: Trump magic or accelerating profits?

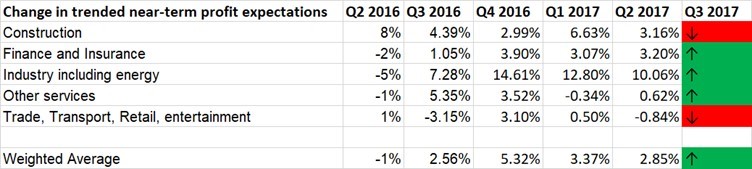

The current outlook for profits – even without any tax reform – remains positive, assuming no mishaps on the international front. Exhibit 2 (below) shows that the rate is positive across most sectors of the economy. Thus, comparisons to the 1990s boom and bust are misplaced, as the rate of profit growth was in fact decelerating during this period and not rising as it is now.

Table 1: Trended near term profit expectations by sector

Source: Credit Capital Advisory

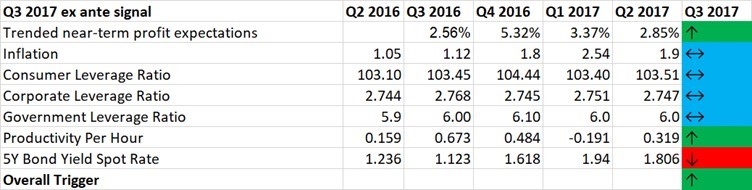

The macroeconomic environment in which these profits are increasing is unusual given that the leverage activity remains largely static across the economy. This suggests that economic agents do not expect future demand to rise much, hence, comparisons to the credit boom during the “great moderation” are also wrong-headed. The only bright spot on the macroeconomic indicators is a mild uptick in productivity.

Table 2: Macroeconomic signals for future profit growth

Source: Credit Capital Advisory

Knowing when to bail

The key from a dynamic asset allocation perspective is to avoid being in equities once profits start falling and valuations head south. This is how investors can preserve capital through the business cycle. Investors should take note of Tolstoy’s criticism of the desire for humans to be provided with simple answers to complex phenomena. It is much more profitable to accept the uncertainty and manage asset allocation accordingly.

Trackbacks/Pingbacks