The recent BREXIT vote should be a wake-up call for investors. The assumption that markets provide greater insight into the probability of certain events occurring was flawed. The betting markets along with the foreign exchange and equity markets were all signalling a “remain” victory. Markets, it seems, under certain circumstances have about as much value as a smith without a hammer.

For many years, prediction market supporters have claimed that markets are the most effective way of gauging and synthesising opinions. I include myself in this group, having co-authored a book on the subject in 2007. Furthermore, as the record of opinion polls has come under increasing scrutiny, journalists have begun to use prediction markets more widely. This makes the market failure to predict BREXIT even more of a shock.

What difference does it make?

Theoretically, the idea of prediction markets is sound. The market mechanism is the most effective way of aggregating and synthesising information. Key to the success of any prediction market is that the traders in the market have access to all available information, and that there are enough of them trading using independent information to reduce any bias.

Chart 1 shows that there was a reasonably strong relationship between sterling and the betting markets. One possibility is that the betting markets were traded by those who used the existing price as a proxy for all available knowledge rather than undertaking their own independent analysis. The currency markets may also have influenced the betting markets, and it is possible that the betting markets provided further feedback and reinforced the currency markets.

Chart 1: British pound effective exchange rate vs probability of remaining in EU

Nowhere fast

One possibility why prediction markets got it so badly wrong is that markets are only able to assimilate existing information; the polls were also predicting a “remain” victory. This idea is that something akin to the spiral of silence was at work, i.e., the tendency of voters to remain silent when they feel their views are in opposition to the majority view. This phenomenon was discovered by a German academic in the 1970s when trying to understand why the CDU performed better in elections than in polling.

This sounds a bit like a get-out-of-jail free card for people like myself who have long supported the value of prediction markets. While this is a plausible idea, the reams of articles explaining why “vote leave” won suggests this is a weak argument. Rather it would seem that the availability heuristic was at work instead, which is something that Philip Coggan, Buttonwood columnist in The Economist pointed out to me at the time. This is where traders were more influenced by the existing market signal rather than any underlying analysis. The close correlation between the betting markets and the currency markets appears to back this up.

Some markets are better than others

In preparing the material for the 2007 publication, a great deal of research went into how the oil market might provide indications of increasing political instability in the Middle East. One of the major findings of this research was that oil options market were not particularly correlated to the futures and spot markets, which are highly correlated.

Using Datastream, a simple but effective signal was developed based on the difference between the implied volatility of deep out of the money puts and calls. A large positive number would imply an expected spike in oil prices or a greater implied volatility of calls. This is sometimes known as a risk reversal.

This signal proved to be far more effective in indicating rises and falls in political risk, utilizing oil price spikes as a proxy. At the time, our explanation for the divergence between the options and spot/futures markets was based on the idea that the “smart money” invested in options, or possibly where those who had access to proprietary information traded.

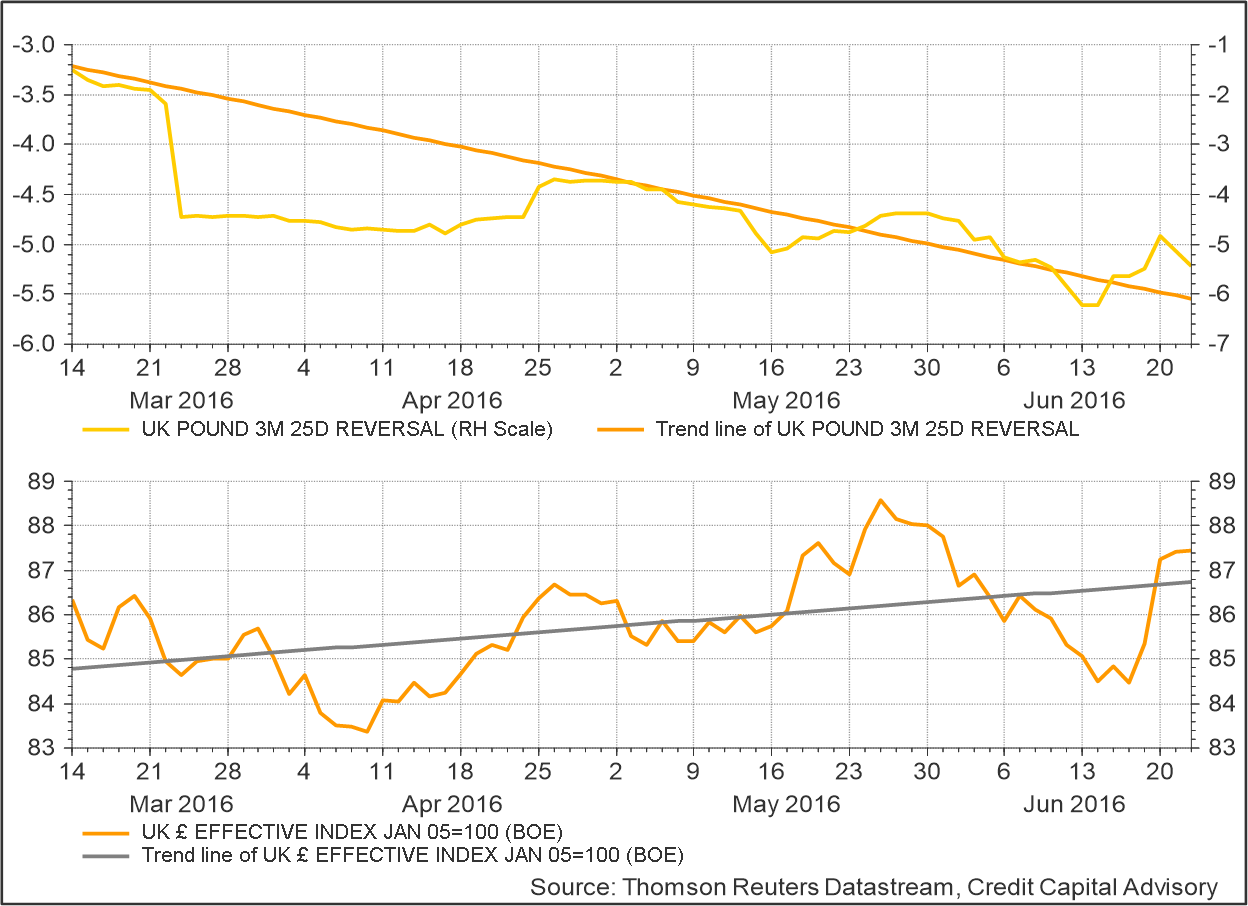

So how well did the FX options market do in predicting BREXIT? Chart 2 shows that the options market had consistently been predicting a BREXIT in the three months leading up to the vote. Indeed, the trend line of the 3 month risk reversal indicator is quite striking.

Between March and June, the FX options market was implying that the demand for sterling options was heavily skewed towards out of the money puts. The jump from around -3 to -6 is extremely significant, however, this information appears not to have been transmitted to the spot market. The effective exchange rate of sterling in fact strengthened over the period, albeit very mildly. This suggests that not all markets are the same, and identifying the “good” markets is critical for investors to make use of the market mechanism to help predict the outcome of events.

Chart 2: FX options vs spot market with trend rates

Money changes everything

This raises two questions. Firstly, why didn’t the spot and futures market pick up on this information? And secondly, can the greater accuracy of the options market really be explained by this is where the “smart money” trades? The answer to the first question is probably more to do with lack of familiarity with the options market. Options information is rarely reported by financial journalists or bloggers, and therefore is generally left to those who trade options. Perhaps this event might lead to greater interest in the options market and as a result might start to break down these information silos.

On the second point, as to whether options traders are really smarter, they certainly looked smarter than most of us on June 24. However, one of the main reasons for buying deep out of the money puts is to insure downside risk to sterling portfolios. Given the fall in sterling, this turned out to be a very sensible risk management strategy. Hence it may well be that those investors who had large exposures were forced to think about these kinds of risks and undertake independent analyses of the risks rather than relying on the opinions of others.

For a prediction market to work, the estimates need to be based on an independent analysis as much as possible. This may be one of the reasons why the options market tends to provide better information as it is driven more by investors trying to hedge large positions as a result of potential market moves. They simply cannot afford to be wrong. It seems that prediction markets still do work after all, but much greater care needs to be taken as to who is playing.