The oasis of calm that investors have become addicted to since the advent of quantitative easing has been rudely interrupted. Between July 20th and August 25th, the S&P Composite fell by more than 12% , triggered by the drop in the Shanghai stock exchange of nearly 40% from its all-time highs. For many investors this has come as a surprise, since U.S. GDP growth is still reasonable and interest rates are still at all-time lows. However, these types of events will continue to negatively impact portfolios, causing capital destruction until investors focus on the change in profit rates across firms, sectors and the wider economy instead of aggregate growth data.

Falling Down

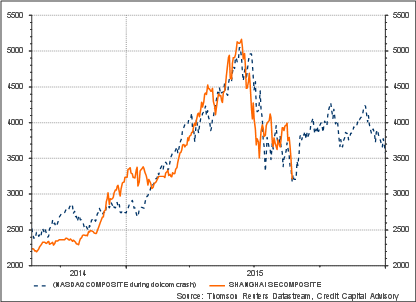

The performance of the Shanghai stock exchange over the last two years has closely tracked that of the NASDAQ during the dot-com boom, driven mainly by a bubble in technology stocks. Following its IPO in March 2015, Baofeng Technology, which develops online entertainment tools, was up 4,200% in less than 2 months. Had the China technology bubble continued a little longer, it might have eclipsed the rise of the NASDAQ listed firm, Xcelera.com. Xcelera.com transformed itself from a realty-based firm into a dot-com holding company in 1999 and saw its stock rise 74,000%. The subsequent collapse of the stock prices of both firms is emblematic of the boom and bust that took place in both markets.

Chart 1 NASDAQ (1999-2000) vs Shanghai (2014-2015) stock markets

The synchronization of the behavior of the NASDAQ and Shanghai stock markets is not a coincidence. Both markets were characterized by falling rates of profit or Wicksellian Differentials – defined as the return on capital minus the cost of capital. Indeed, investors have been warned of a falling rate of profit in China for some time.

When stock prices rise with falling profits or Wicksellian Differentials as shown in chart 2 below, it implies a complete detachment of asset values to underlying fundamentals or in technical speak, an asset bubble. As such, one would expect the behavior of markets to be pretty similar, driven by underlying factors such as confirmation bias – where investors seek facts to support their conclusion of rising prices — and recency bias – the tendency of investors to think that recent trends are more likely to continue in the future and the herding nature of markets – where investors have a tendency to mimic the actions of other investors.

Chart 2 Falling Wicksellian Differentials US (1997-1999) and China (2012 – 2014) and stock markets

What’s the story…

These two episodes need to be distinguished from what has been happening in the United States since 2011. The characteristics of the recent US bull market have not been bubble-like, but rather due to rising profits as shown by the rising orange bars in chart 3. These rising bars have been supported by a falling cost of capital as a result of quantitative easing. When the profit rate or Wicksellian Differential is rising, higher equity valuations are justified. When the Wicksellian Differential falls as shown in the blue bars in chart 3 below for the U.K., lower valuations are the result. Given the flattening of the Wicksellian Differential in 2014 in the U.S., equity markets are unlikely to be that buoyant unless there is another bubble or profits start to rise again due to higher levels of productivity.

Chart 3: Rising Wicksellian Differential and equity markets UK & US: 2011 – 2014

Unfortunately for investors in the U.S. market, the ex-ante outlook for the return on capital is not rising. As was highlighted towards the end of 2014, ex ante indicators of the Wicksellian Differential have begun to reverse, indicating that the rate of profit is expected to fall, implying lower equity valuations.

The Q2 2015 outlook is still in decline – although at least in positive territory buttressed by a strong U.S. banks outlook. Despite this downward pressure however, the probability of the U.S. market crashing 40% like it did in 2008 is low for two reasons. As 2008 unfolded, all sectors were seeing large falls in expected profits. That is not the case now – although industrials and energy is taking a reasonably large hit. Secondly, the extent of corporate and consumer leverage is far lower than in the 2008 period.

Where did it all go wrong?

Investors need to discard the current metrics of analyzing small changes in GDP growth to signal shifts in valuations if they are to preserve capital through the business cycle, particularly as there is no evidence that stock returns and economic growth are correlated. Instead, investors should focus on changes in profit rates or the Wicksellian Differential. Particularly as the basic valuation equation – the dividend discount model – is dependent on expected future cash flows which is driven by, yes, profits.

Investors also need to accept that the cost of capital is likely to tick up at some stage, albeit mildly. This should be welcome, as firms are unlikely to start investing until the central bank signals the end of extraordinary monetary policy measures. This means that instead of relying on refinancing strategies to drive up profits, firms will need to become more productive in the way they deploy labor and machines.

Hence, investors should spend less time obsessing about the rise in interest rates and focus instead on the quality of management plans and vote on these accordingly. The potential for firms to innovate and grow is significant, but unless firms have the right management in place this is less likely to happen.

Trackbacks/Pingbacks