Most investors got caught out by the last monetary policy fad by using the level of inflation as a proxy for asset price sustainability and lost a great deal of money. As a result many economists have become critical of the utility of inflation targeting. But will the next big idea be any different? The next big thing in monetary economics may well be for central banks to target nominal GDP. Unfortunately “the next big thing” in monetary economics does not have a very good track record. From Keynesian demand management through to monetary aggregate targets and more recently inflation targets, the next big thing has always led to severe and substantial unintended consequences. However, the arguments of the market monetarists, in particular of Scott Sumner, are cogently made postulating the idea that the drop in nominal GDP was in fact the major cause of the crisis itself. Hence more monetary stimulus ought to have been used to have boosted nominal GDP to ensure it remained on track. These arguments are of course reminiscent of the Friedman and Schwarz analysis of the Great Depression.

Before addressing the NGDP issue specifically, it will pay dividends to return to Friedman’s ideas on monetary policy which led him to develop his monetarist philosophy in the first place. In his seminal 1968 paper The Role of Monetary Policy, Friedman argued that “the most important lesson that history teaches about what monetary policy can do… is that monetary policy can prevent money itself from being a major source of economic disturbance.” In essence, Friedman was arguing for monetary policy to be neutral so it wouldn’t shock the economy in a positive or negative way. Such a neutral monetary policy would allow producers and consumers to get on with their daily activities without any monetary distortions, thus allowing the market to function more efficiently. Friedman had been rightly critical of the post-war interventionist behaviour of central banks which led to rampant inflation. The problem of course is that monetary aggregate and more recently inflation targeting did not lead to economic stability, thus invalidating the idea that either of those policies was “neutral”. If a 5% nominal GDP target were able to create neutral conditions then it would indeed be a very good idea.

The main issue with a 5% nominal GDP target is that it ignores credit growth. Sustained excess credit growth as many economies have demonstrated can lead to catastrophic outcomes, something that Claudio Borio and Bill White at the BIS pointed out over a decade ago. Crucially, credit growth does not necessarily reveal itself in rising nominal output as more often than not credit growth is used to inflate asset values rather than higher investment in physical assets which would generate higher nominal output. Thus a nominal output target would not have prevented the credit boom and the subsequent financial crisis. George Selgin’s post on intermediate spending booms argues this persuasively.

In essence, a neutral monetary policy is only neutral when credit markets are in equilibrium, and most analysis of credit markets highlights they are hardly ever in equilibrium. However, it is possible for a central bank to use the nominal rate of interest to create neutral credit conditions using the credit-based macroeconomic framework of the great Swedish economist Knut Wicksell. According to this framework, a neutral policy exists when the return on capital is equal to the cost of capital at the macroeconomic level. This means that when economic activity is spurred by productivity increases and demand shocks, the nominal rate of interest needs to be raised to curtail excess credit growth which comes about due to the increase in profits. Such an approach, known as the productivity norm, has been advocated by numerous economists including Hayek and Myrdal, the 1974 Nobel Prize winners, as well as more recently by George Selgin. Unfortunately, macroeconomic theory that takes credit into account remains on the outside of the periphery of central bank thinking, despite the BIS’s numerous attempts to change that. As a result we can only expect more boom and bust given that a 5% NGDP target will essentially ignore what is happening in credit markets. It is important to emphasise that a productivity norm approach is very close to an NGDP target, although an equilibrium level is more likely to be around 2-3%.

The oscillation of boom and bust does however provide active investors the opportunity to profit by monitoring the rate of credit growth based on the changing dynamic of the rate of profit, and switching their investments out of risk assets before the next bubble bursts. Investors who remain in risk assets all the way through the cycle will find that their returns continue to get hit by future downturns. In my book Profiting from Monetary Policy I use a neo-Wicksellian framework to empirically measure the extent of credit disequilibrium allowing investors to avoid the catastrophic falls in the value of capital which is more often than not driven by “monetary” disturbances. Such a framework can also highlight to central bankers the extent of the disequilibrium in credit markets should they care to look.

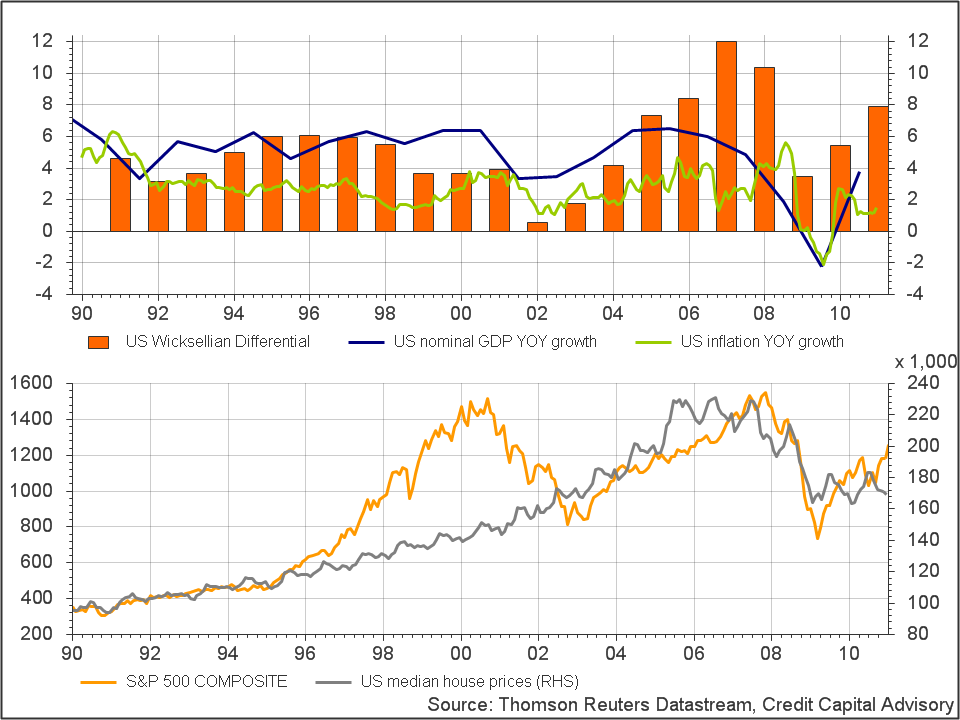

Chart 1: Top pane: US Wicksellian Differential, nominal GDP & inflation

The top pane shows the orange bars which is the Wicksellian Differential for the US economy – defined as the return on capital minus the cost of capital on an annualised basis. As this is the driver for credit growth, it provides a good proxy for credit disequilibrium given trying to identify all the areas of credit growth in relation to the level of productivity is a gargantuan, if not impossible task. If there was equilibrium in credit markets then the orange bars would be effectively zero. The blue line shows Sumner’s “equilibrium” NGDP figure oscillating around the 5% level. The problem with this 5% figure is that it was impacted by increasing leverage as credit markets were not in equilibrium throughout the period which the orange bars show as they were mostly substantially above zero. Furthermore, the bottom pane highlights how the cumulative growth in credit flows into financial assets creating the boom phase of the bubble. This is why credit bubbles do not necessarily reveal themselves in accelerating nominal output, and hence why a 5% NGDP target will most likely miss the next credit bubble.

A credit-based analysis of the economy provides a slightly different perspective to Sumner’s monetary approach. It argues that the fall in NGDP was caused by the shift in expectations that the high levels of leverage were no longer sustainable, thus leading to deleveraging. When a process of deleveraging starts, future cash flows become insufficient to pay back the level of debt due to falling aggregate demand, which feeds back into the deleveraging process. The only way a 5% NGDP target might have been maintained throughout the crisis (besides a massive fiscal stimulus which would not have been sustainable given interest rates would most likely have risen) would have been to have convinced consumers that such high levels of leverage were in fact sustainable. Most likely this would have required house prices to have kept on rising which even the Fed is not able to control. The reality is that central banks would be better off taking Friedman’s advice and preventing themselves from creating the disturbance in the first place and that means taking credit growth into account. However, that may be a political impossibility. If that’s the case then at least investors, using credit growth indicators, can insulate themselves by riding the next asset bubble and switching out of risk assets in order to avoid the next catastrophic fall in the value of capital.

Trackbacks/Pingbacks