On September 1st 1859, astronomer Richard Carrington observed what turned out to be a coronal mass ejection from the sun, which released a significant amount of plasma into the solar wind. The resulting geomagnetic storm, known as the Carrington Event, was so severe that when it reached Earth it knocked out large chunks of the global telegraph communications system.

The economist William Stanley Jevons thought that sunspots were the causes of business cycles, which can be understood as an early exposition of real business cycle theory. Jevons didn’t think that an economy could become unstable by itself and could only be blown off course by exogenous factors. Since Jevons, there have been numerous theories put forward to explain the causes of cycles; both endogenous and exogenous.

One challenge for many of these theories is that no cycle is the same, because the underlying structure of an economy is subject to constant change. Hence, understanding when an economy is structurally shifting or starting a new regime is central for investors who wish to improve returns. Despite the existence of cycles and regimes, the increasing flow of funds into passive investments suggest that many investors have given up on the idea that it is possible to generate excess returns above buy and hold.

While this might be the case for stock picking, getting the asset allocation right is far more important. Indeed, credit cycle investing continues to outperform equity buy and hold by over 60% since 2008. In addition to responding to profit outlooks and leverage, a dynamic asset allocation framework enables investors to react to new risks and opportunities including pandemics such as the coronavirus as well as the shift towards a data fuelled economy.

Since the Credit Capital Advisory asset allocation signal for the U.S. market shifted from a positive to negative outlook for profit growth at the end of February 2019, returns for equities and bonds have both been strong. While the S&P 500 returned 17% compared to global equities at 11% and all bond maturities at 11%, active investors in US technology stocks would have returned 31%. However, that was bettered with a return of 35% for long dated U.S. government bonds.

Chart 1: Equity and Bond Returns, March 1, 2019 to Feb. 24, 2020

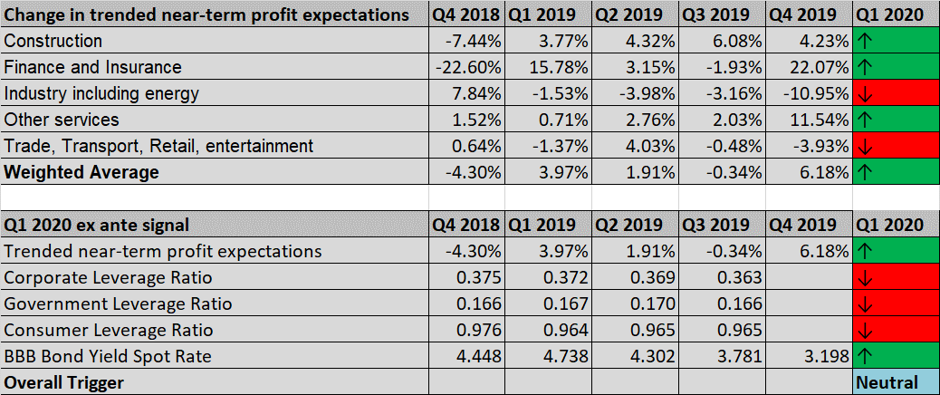

The recent Q1 2020 signal has indicated a shift from a negative to a neutral outlook. This has been largely driven by the improvement in the outlook for other services which is mostly related to technology, and some additional support from financial services. Despite this improvement, a late credit cycle outlook still appears to be the appropriate interpretation given that all leverage ratios are still negative. This indicates consumers and firms still have reservations about rising future demand and therefore are reluctant to further extend leverage for consumption and investment.

Table 1: Near Term Outlook for Profit Expectations

Source: Refinitiv Datastream, Credit Capital Advisory

The improvement in the profit outlook for technology providers is related to the increase in demand for data management services. This is expected to continue to grow for many years as the data-fuelled economy finally becomes a reality. Managers of firms in other sectors are increasingly betting that the ability to exploit data will improve their profitability. However, there are few signs it has yet increased profitability outside of the tech firms.

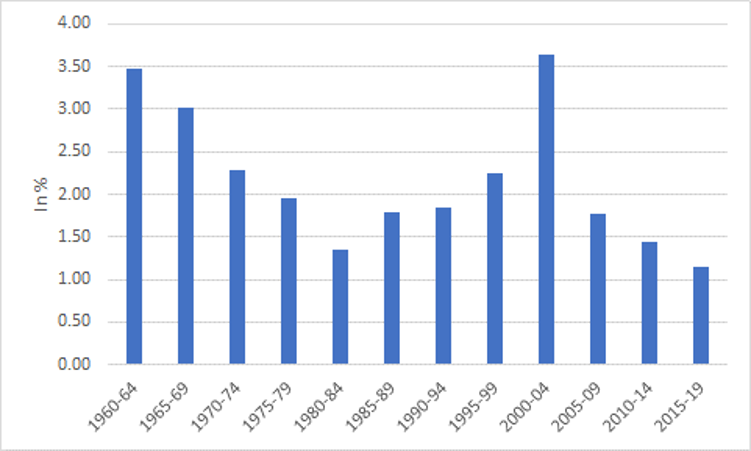

One interesting effect of this shift, if it is sustained, is that it should result in higher labour productivity growth. Given that the last five years has seen the slowest rate of productivity growth since the 1960s, this would be welcome for the broader economy.

Chart 2: Average Labour Productivity Growth – U.S.

Source: Refinitiv Datastream, Credit Capital Advisory

During the late 1980s, Robert Solow famously quipped that the computer age was everywhere except in the productivity statistics. Between 1995 and 2004, the computer age did start to reveal itself in the productivity statistics, and not just in technology firms but also in retail and distribution. Indeed, a famous McKinsey study suggested that Walmart played a key role in this productivity growth by using technology to re-shape global supply chains.

If the demand for data management services does lead to an increase in labour productivity, it is important to note that higher labour productivity growth is generally associated with lower stock market returns. The firms that are able to capitalize on the opportunity to exploit customer data will see higher returns. But these winners will displace many more firms in a Schumpeterian process, which is why, on aggregate, the stock market is likely to perform less well. This clearly provides opportunities for active investors given that passive investors may well lose out if labour productivity rises.

This partly positive outlook however does not take into account the ongoing concerns related to the coronavirus. In recent weeks investors have been far too sanguine about the potential effects of the virus, which is why the stock market fall on February 24th was so significant. In 2005 I led a study for the World Economic Forum using prediction markets to assess the effects of non-financial risks on the economy including pandemics. This followed on from the SARS outbreak in 2003.

The study used prediction markets to assess the spread and impact of the bird flu virus or H5N1, which the WHO stated in 2004 would trigger an international pandemic that could kill up to 7 million people. The results were presented at Davos in January 2006 and were subsequently published in Prediction Markets: The End of the Regulatory State?

The data from the prediction market indicated that if the H5N1 virus was contained in Asia, it would still have a negative effect on U.S. stock markets, although less than 1%. At the height of the H5N1 crisis in May and June of 2006, the U.S. stock market fell by nearly 7%, mostly driven by higher than expected inflation, although some of this fall was likely due to the effect of the virus. The prediction market data also indicated that if the virus spread to the U.S., the stock market could be expected to fall by around 10%.

Assuming the virus is contained, the effects on the U.S. market at least in the short term are still likely to be material. The H5N1 prediction market data suggests a fall of around 2% if the virus is contained based on the fact that the Chinese economy is about three times larger than it was in 2006. This equates to a short-term S&P 500 level around 3,200 which is roughly where it settled at the close of business on February 24th. If the virus does spread across Europe and the US, then levels can be expected to go much lower, and default rates can be expected to jump.

With regards to default rates if the virus is contained, it is likely that CCC rated bonds will be affected by this slowdown given they have already decoupled from B rated bonds. In addition, there is likely to be a decoupling between B and BB, which may curtail potential refinancing for B rated issues.

Chart 3: Spread Between Bond Indices by Credit Grade Jan 2018- Feb 2020

While there is increasing evidence that active stock pickers are unable to beat the market, dynamic asset allocation using a credit cycle framework continues to outperform. A dynamic asset allocation framework that identifies both endogenous and exogenous shifts in the economy can take account of the sectoral opportunities while avoiding the pitfalls of buy and hold when capital values plunge.